US President Trump has stated that tariffs on imports from Europe to the US will be announced “very soon,” claiming that Europe “takes almost nothing from us, and we take everything from them.” I believe it is important to clarify some basic facts. International trade involves both goods and services, yet Trump refers only to goods. If one were to consider only services, Europeans could just as easily argue that “the US takes almost nothing from us (Europe), and we take almost everything from them.”

As everyone knows, US President Trump considers “tariff” to be “the most beautiful word in the dictionary.”

The type of tariffs he favours—those on imports of goods to the US—drive up prices on imported goods in the US, reducing the purchasing power of American households and ultimately harming US consumers. They also hurt foreign countries by restricting their exports to the US. In essence, tariffs bring little benefit.

These points are obvious to most. However, there are other, often overlooked, aspects of this debate that I believe people should be aware of.

Tariffs on Europe

In early February, Trump’s frustration was aimed at Europe. He declared (link): “They don’t take our cars, they don’t take our farm products, they take almost nothing, and we take everything from them—millions of cars, tremendous amounts of food and farm products.” He also described the European Union as “an atrocity” for what it had done (link).

If this were not enough, Trump upped his rhetoric this week (link): “The European Union was formed to screw the United States—that’s the purpose of it, and they’ve done a good job of it. But now I’m president.” He went on to announce that tariffs would be introduced “very soon.”

Strong words from a president (“an atrocity”, “EU formed to screw the US”). As is so often the case with Trump’s statements, they are certainly provocative but—to put it politely—fail to tell the full story.

Trade between Europe and the US

Trump focuses on “cars, farm products, and food”—in other words, goods. It is true that Europe exports more goods to the US than Europe imports from the US.

However, the US does not only produce and export goods—it also produces and exports services. US banks sell their services to European banks and business. US consultancy firms earn revenue from their European clients. US IT giants (Amazon, Microsoft, Netflix) sell digital services to European business. And so on.

Here is the point: when it comes to services, Europe imports more from the US than it exports to the US. From this perspective, Europeans could just as easily claim: “We (Europeans) take everything from them (the US), and they take almost nothing from us.”

Trade balance

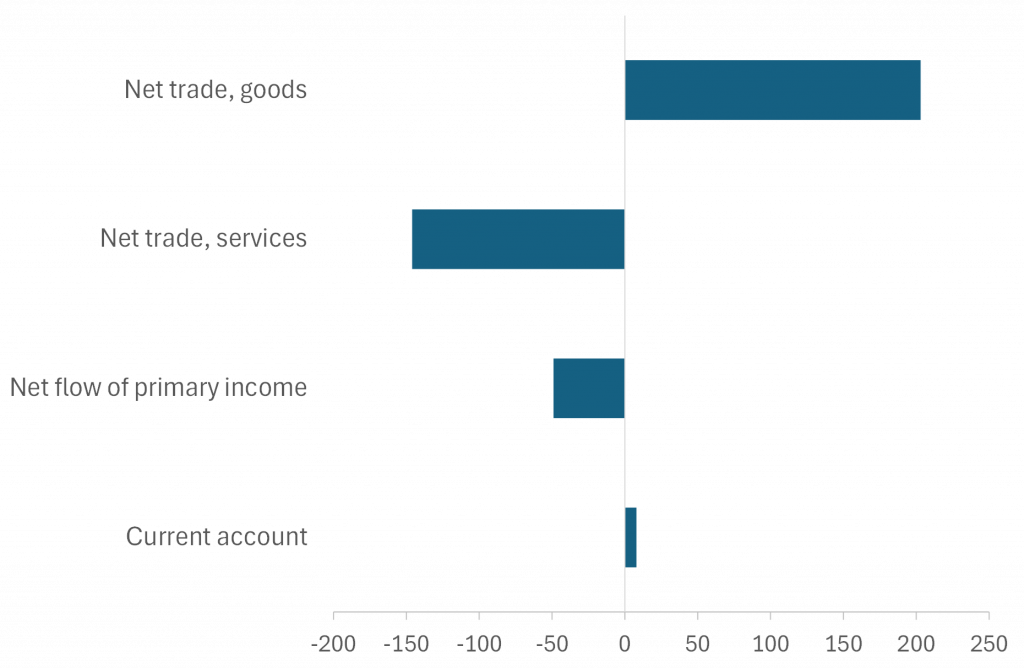

The current account of the balance of payments records flows of funds resulting from imports and exports of goods and services, as well as what is called primary income. Figure 1 presents the most recent data on the euro area’s current account balance with the US.

Figure 1. Main components of the euro area current account towards the US. The four quarters to the third quarter of 2024, billions of euros. Source: ECB (link) and J.Rangvid.

Figure 1 shows that the euro area has a net surplus in its trade balance of goods with the US. Over the past four quarters (Q3 2023 to Q3 2024), the value of goods produced in the euro area and sold to the US exceeded the value of goods imported from the US to the euro area by €203 billion. This difference is what Trump refers to when he is saying that Europe takes little from the US, and the US takes a lot from Europe.

At the same time, as Figure 1 illustrates, the euro area ran a net deficit in its trade of services with the US. The value of services produced in the US and sold to the euro area was €146 billion higher than the value of services exported from the euro area to the US.

So, while Trump is correct in stating that Europe sells more goods to the US than it buys, he fails to mention that the opposite is true for services. Why he focuses solely on trade in goods is unclear—perhaps he considers it more important. To me, both goods and services generate income, create jobs, and contribute to economic well-being, i.e. they are equally important.

Current account

While the US still runs a trade deficit with Europe when taking into account both goods and services, it is small, and when taking all items on the current account into account, the account balances.

First, the overall US trade deficit (= the Europe trade surplus) of €57 billion (= €203 billion – €146 billion) is negligible relative to the size of the US economy. In 2024, US GDP amounted to $29 trillion, meaning the trade deficit with Europe accounts for less than 0.2% of US GDP.

Moreover, when discussing international flows of funds, what truly matters is not just the trade balance in goods and services but the overall current account. This brings us to the final key component shown in Figure 1: primary income.

Primary income includes wages earned by euro area residents from employment in the US, as well as income from financial investments (e.g., dividends), minus payments on those same items made to the US. For the euro area, this figure stands at a negative €49 billion, implying that Europe pays more financial income and wages to the US than it receives from the US.

In total, the euro area’s current account with the US is effectively balanced (€8 = €203 billion – €146 billion – €49 billion), as illustrated in Figure 1.

Importance of trade between Europe and the US

This pattern—of a US trade surplus in services and a deficit in goods—has persisted over time. This webpage (link) provides several other interesting insights into trade between the US and Europe. For example, the European Commission states:

- “The European Union and the United States have the world’s largest bilateral trade and investment relationship, and enjoy the most integrated economic relationship in the world.”

- “Millions of jobs in the United States are related to EU-US trade and investment.”

- “The European Union is a reliable source of critical supplies to the United States, including medicinal ingredients and pharmaceutical products, advanced machinery and equipment, and aerospace parts and components.”

- “At the same time, the European Union is the largest buyer of the United States’ natural gas and oil.”

Once again, perhaps we should focus on promoting trade rather than restricting it—for the benefit of both Americans and Europeans.

Current and financial accounts

Current accounts are often discussed because they provide insight into a country’s need for foreign financing or investment. Hence, the opposite of the current account on the balance of payments is the financial account. The financial account includes capital flows related to international trade in financial assets.

As any student in my MBA International Finance course knows, the current account and the financial account (within the balance of payments) must always sum to zero—aside from statistical errors and omissions in the data. In other words:

Current account + Financial account = 0.

When a country runs a current account deficit, it has a financial account surplus, meaning it is exporting financial assets to other countries.

European holdings of US treasuries

Here, let’s focus on US Treasuries. Given that the US does not run a significant current account deficit with Europe, it is unsurprising that Europe is not the largest holder of US Treasuries.

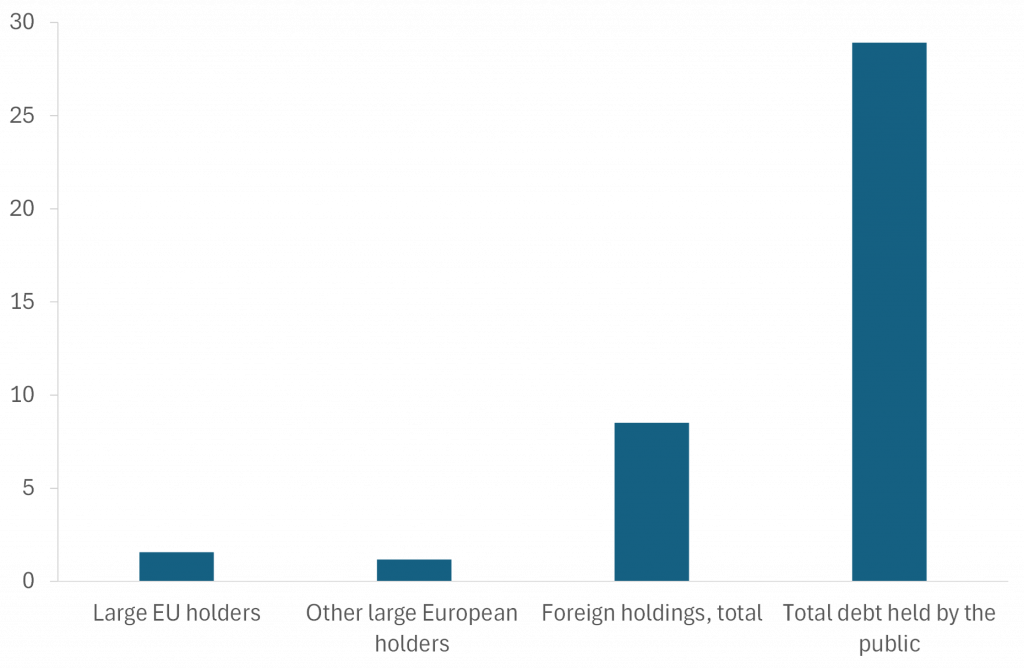

Total US public debt currently stands at $36.2 trillion (link). Of this, $7.3 trillion is held by other US government agencies (primarily the Federal Reserve), leaving $28 trillion held by the public.

Out of that $28 trillion, $8.5 trillion is held by foreign investors. As shown in Figure 2, the largest EU holders of US Treasuries (Luxembourg, Ireland, France, Belgium, and Germany) collectively hold $1.5 trillion. An additional $1.2 trillion is held by other major European investors, including Switzerland, the UK, and Norway.

Why does this matter? Even if tariffs—though this is a very big “if”—manage to reduce the US trade deficit, they would also decrease foreign purchases of U.S. financial assets (again: current account + financial account = 0). However, since Europe is not the largest holder of US Treasuries, any reduction in European demand would have a limited overall impact on Treasury demand.

Figure 2. Foreign holdings of US Treasury securities. Trillions of US dollars. December 2024. Source: US Department of the Treasury (link) and J.Rangvid.

If Europe is not a major owner of US Treasuries, then who is, and how much influence do they have over Treasury demand? I cannot cover it all today, so I will return to this question in a future analysis.

Conclusion

Trump’s latest tariff threats are aimed at Europe, based on his claim that Europe “takes almost nothing” from the US.

While it is true that the US runs a trade deficit in goods with Europe, it also enjoys a large trade surplus in services and is a net recipient of primary income from Europe. In fact, if we were to focus only on services, just as Trump focuses only on goods, one could just as easily argue that the US “takes almost nothing from Europe, while Europe takes almost everything from the US.” Clearly, cherry-picking certain components of trade leads to a misleading discussion.

But doesn’t the US have a large current account deficit when considering the rest of the world? Yes, but not with Europe. And doesn’t this overall (i.e. towards all countries) US current account deficit mean that foreign investors own a substantial amount of US assets? Yes—and I will explore this in a future analysis.

The key point here—given Trump’s tariff threats against Europe—is that the current account between the euro area and the US is balanced. Hence, a more accurate statement would be:

“They take as much from us as we take from them.”