Interesting papers, Stock markets

A fact-based blog on finance and economics

Page 1/2

Interesting papers, Stock markets

Interest rates, Interesting papers, Return expectations, Stock markets

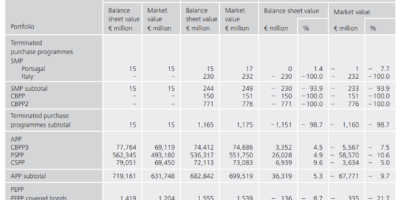

Central banks, Eurozone, Interesting papers, Monetary policy

Interesting papers, Real estate prices, Recessions

Interesting papers, Stock markets

Financial stability, Interesting papers, Monetary policy, Real estate prices, Stock markets

Financial markets, Interest rates, Interesting papers, Stock markets

Corona crisis, Credit markets, Danish economy, Eurozone, Financial markets, Financial stability, Interesting papers, Monetary policy, Stock markets

Interesting papers, Stock markets

Interesting papers, Monetary policy