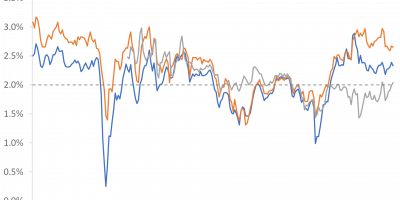

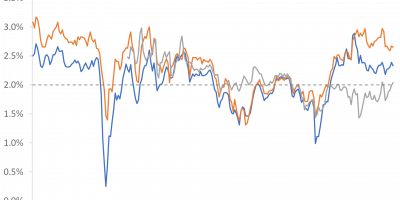

Inflation, Inflation expectations, Real interest rates

A fact-based blog on finance and economics

Page 1/1

Inflation, Inflation expectations, Real interest rates

Central banks, Inflation, Inflation expectations, Monetary policy

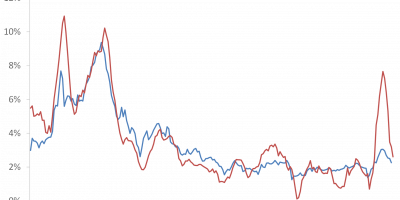

Inflation expectations, Oil, Uncategorized

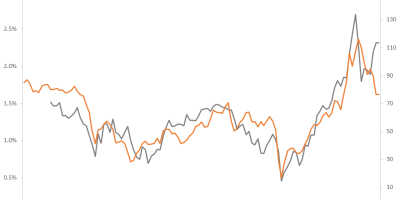

Eurozone, Inflation expectations

Central banks, Inflation, Inflation expectations, Interest rates