Interesting papers, Stock markets

A fact-based blog on finance and economics

Page 1/3

Interesting papers, Stock markets

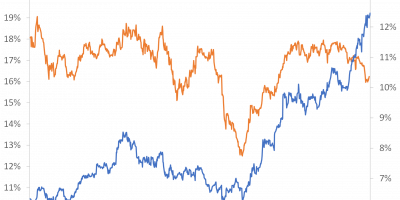

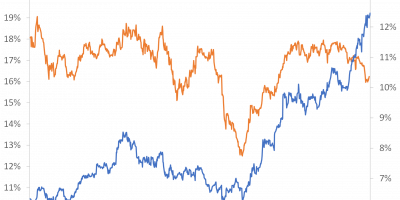

Interest rates, Interesting papers, Return expectations, Stock markets

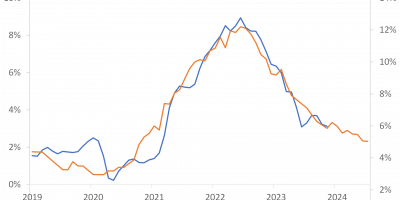

Central banks, Inflation, Monetary policy, Recessions, Stock markets

Financial markets, Interest rates, Monetary policy, Stock markets

Central banks, Monetary policy, Stock markets

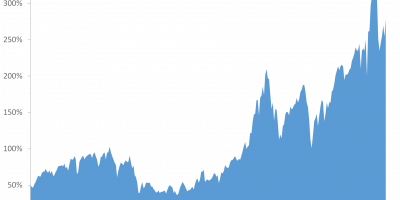

Interesting papers, Stock markets

Financial stability, Interesting papers, Monetary policy, Real estate prices, Stock markets