Central banks, Eurozone, Interesting papers, Monetary policy

A fact-based blog on finance and economics

Page 1/1

Central banks, Eurozone, Interesting papers, Monetary policy

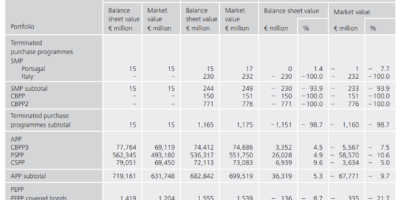

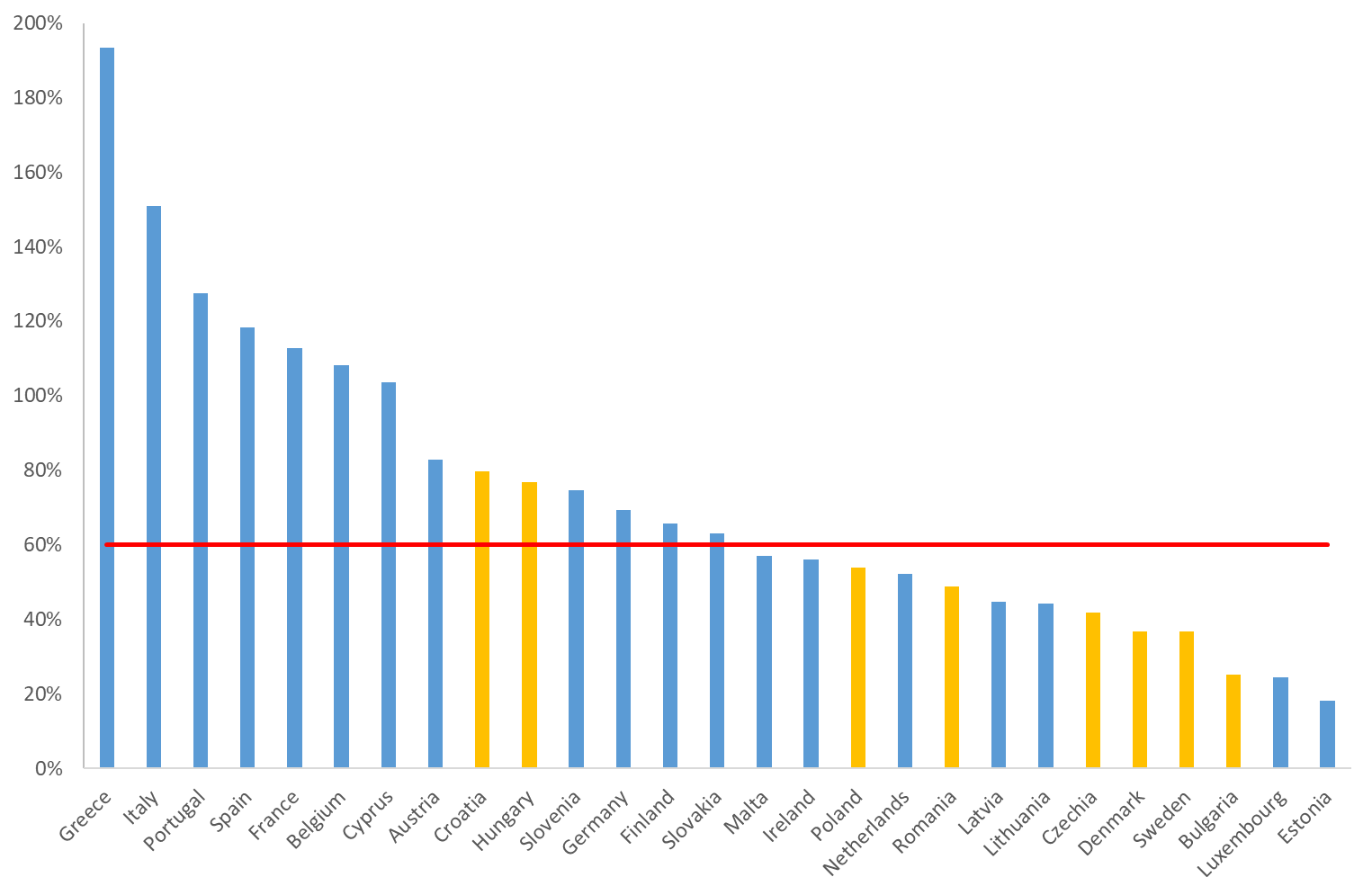

Central banks, Debt, Eurozone, Monetary policy

Central banks, Debt, Eurozone, Inflation, Monetary policy

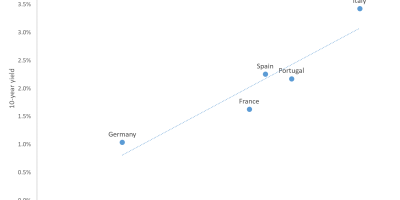

Eurozone, Inflation expectations

Eurozone, Inflation, Monetary policy, Oil

Central banks, Eurozone, Inflation, Interest rates, Monetary policy

Corona crisis, Credit markets, Danish economy, Eurozone, Financial markets, Financial stability, Interesting papers, Monetary policy, Stock markets