Category: Interest rates

Page 1/2

Central banks, Inflation, Interest rates, Monetary policy

Monetary policy in the 1970s and today

Interest rates, Interesting papers, Return expectations, Stock markets

The expensive stock market

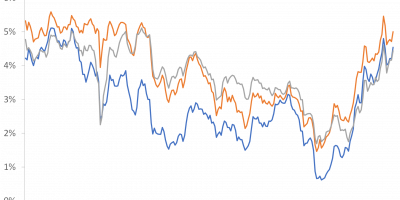

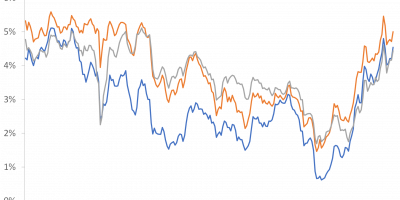

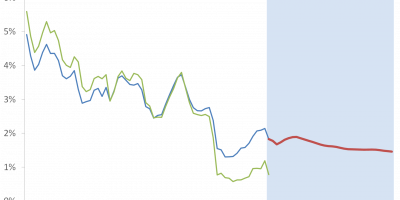

The future of r*

Have interest rates risen fundamentally?

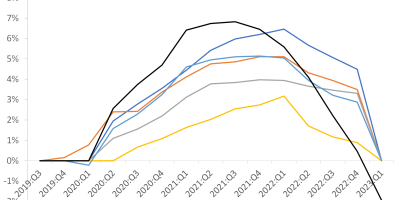

Corona crisis, Interest rates, Monetary policy, Recessions

Why no recession (yet)?

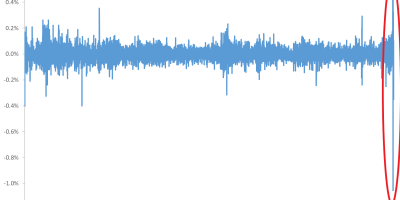

Central banks, Interest rates, Monetary policy

The Fed is bankrupt, but it’s unrealised

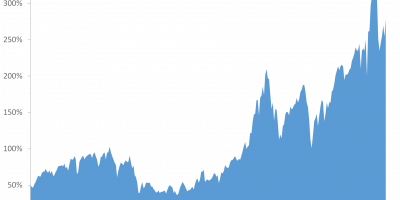

Financial markets, Interest rates, Monetary policy, Stock markets

Where is the liquidity?

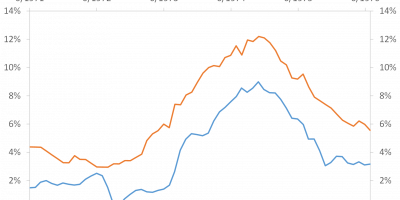

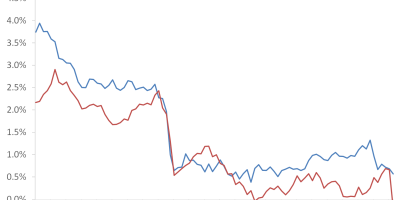

Central banks, Inflation, Inflation expectations, Interest rates

Is euro area monetary policy tight or loose?

Central banks, Inflation, Interest rates, Monetary policy