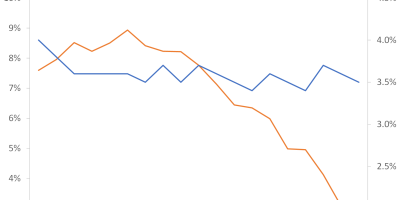

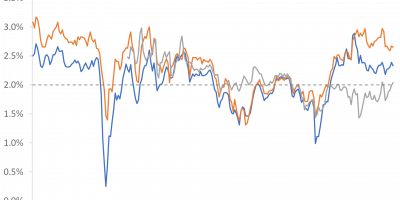

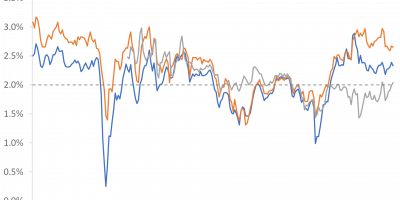

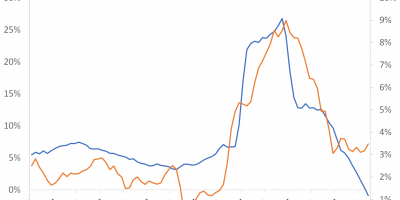

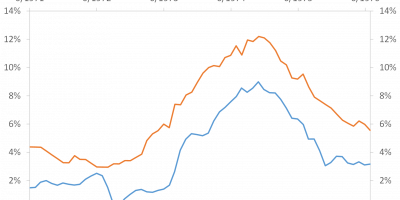

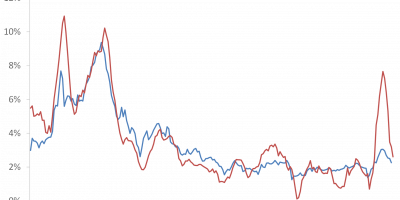

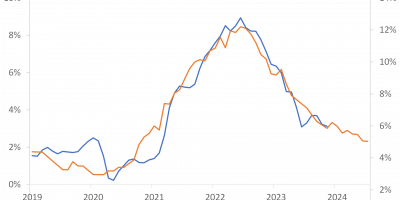

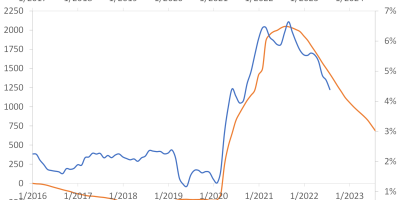

Inflation, Inflation expectations, Real interest rates

A fact-based blog on finance and economics

Page 1/3

Inflation, Inflation expectations, Real interest rates

Central banks, Inflation, Interest rates, Monetary policy

Central banks, Inflation, Inflation expectations, Monetary policy

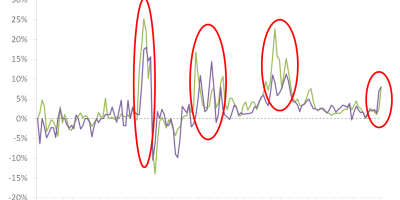

Central banks, Inflation, Monetary policy, Recessions, Stock markets

Corona crisis, Fiscal policy, Inflation