A couple of weeks ago, I collected some graphs revealing how deep this recession is (Link). Two weeks have passed. New data have arrived. They are still horrifying.

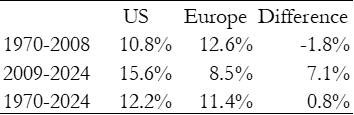

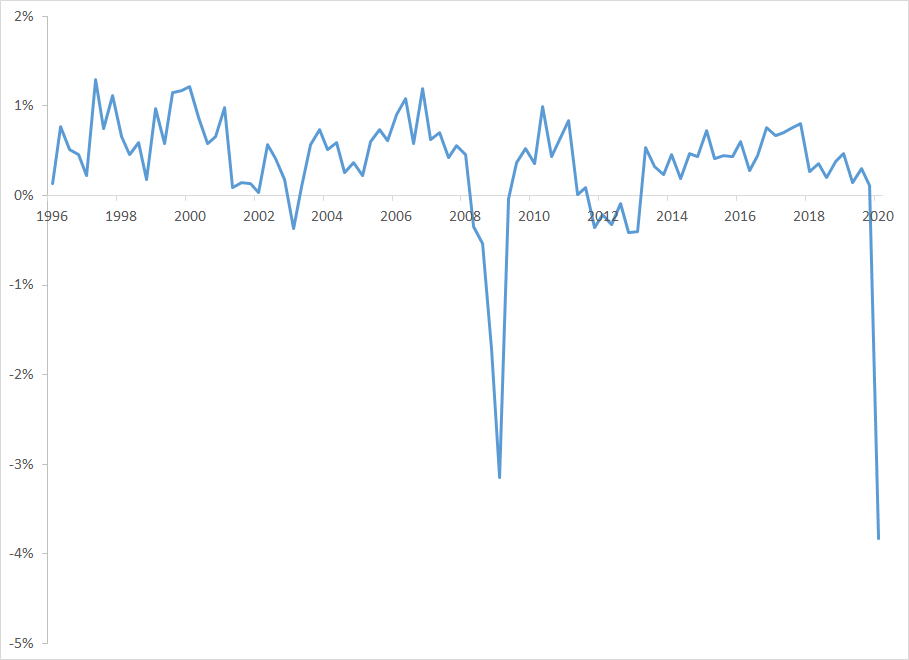

We now have aggregate numbers for Europe. In the first quarter of 2020, Eurozone GDP dropped more than it did during the worst quarter of the financial crisis of 2008:

Data source: ECB.

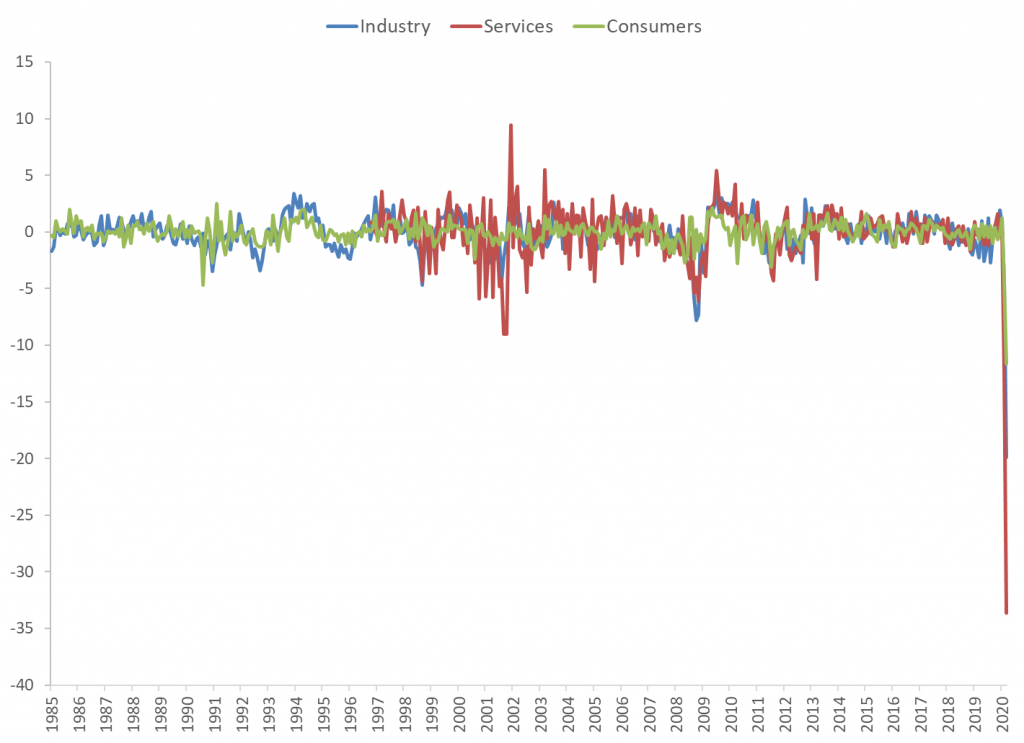

GDP figures are aggregate data. They show how total economic activity has developed. That’s why they are important. They are, however, also a snapshot of the level of economic activity, collected with a lag. The latest figures deal with the first quarter of 2020. So what about asking firms and households how they feel and how confident they are? If people and firms think this will be a short-lived recession, they should be confident. The EU commission publishes confidence indices for firms in the industrial sector, the services sector, and for households in the EU. Confidence indices drop, as we have never seen before.

Data source: EU commission.

The industry, the service sector, and households all have no confidence in the economy.

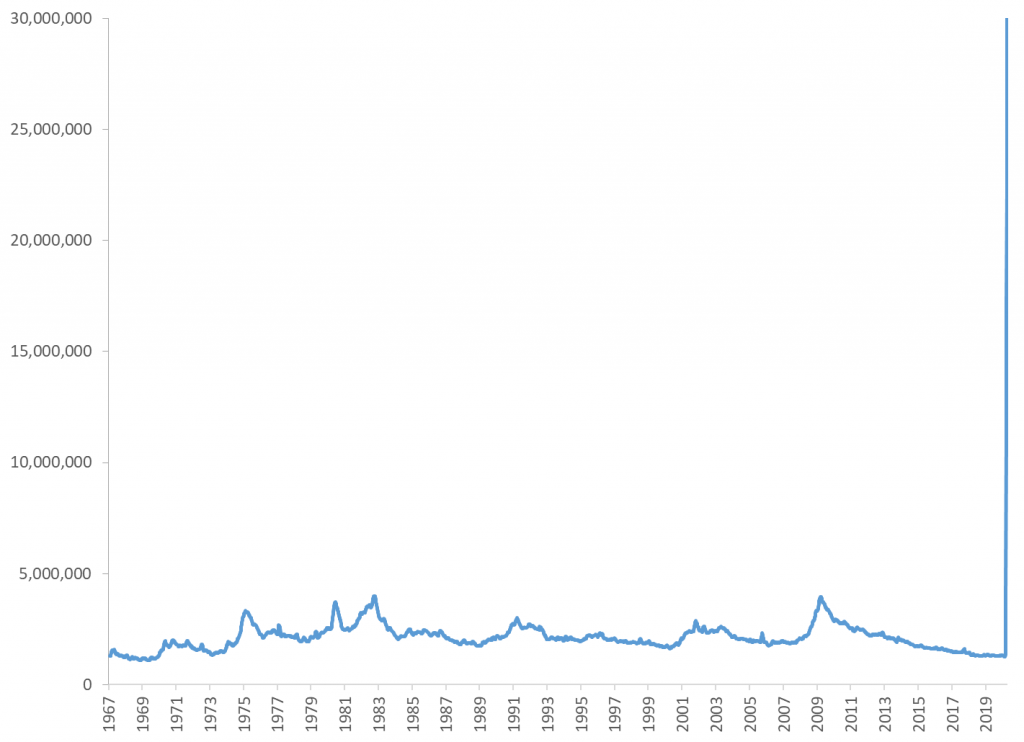

Next, I collect trailing averages of initial jobless claims in the US during the preceding six weeks. During the past six weeks, more than thirty million Americans have lost their jobs. It is not just a historical record. It is very sad.

Data source: St. Louis Fed.

Most likely the unemployment rate will come in at close to 20%.

Behind all these numbers and figures, there are real firms and real people. Firms will be forced to close. Individuals will lose their jobs. Households will struggle.

So, how does the stock market do? Given the scale of the recession, you would expect it to suffer tremendously. It does, however, great.

From its temporary trough on March 23, the SP 500 has gained 32%. It tanked heavily in late February and early March, but it is today (May 1) “only” 13% below its peak on February 19. I write “only” as the stock market often losses something like 50% in a recession (Link). This recession is unprecedented, as shown above, so you would expect unprecedented losses on the stock market. This is not what we see.

It is not unusual that the stock market starts rising before the end of the recession . And the stock market did fall very fast early in the recession. In the US, it was the fastest bear market ever (Link). But given the depths of the recession, stock markets have rebounded surprisingly fast.

True, not all stock markets have rebounded. The Spanish stock market (MSCI Spain) is 30% below its peak on February 19. So is the Italian. And, the Argentine is down 31%.

So, some stock markets have rebounded strongly, but others have not. Let us try to get an overall picture.

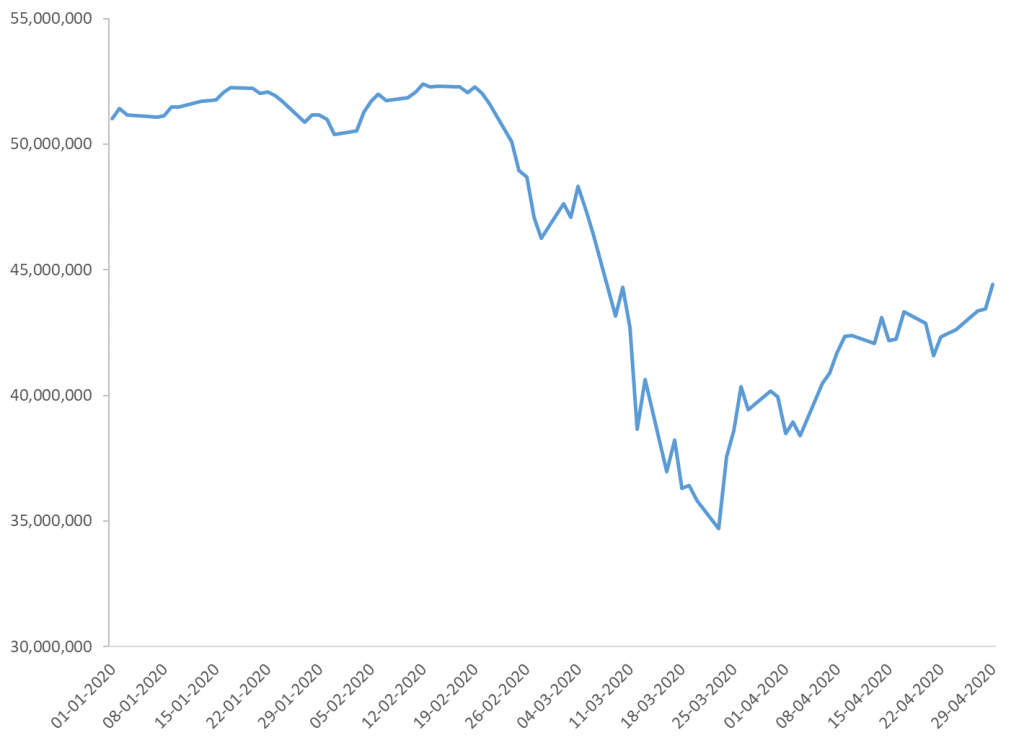

This is a global recession. The aggregate value of global stocks markets is USD 44 trillion on April 29 (FTSE All World Index). On February 19, it was USD 52 trillion. At the bottom on March 23, it was USD 35 trillion.

Data source: Thomson Reuter Datastream via Eikon

This means that 20,000 billion USD(!) was lost on the stock market from February 19 through March 23, globally. It also means, however, that almost 10,000 billion USD have been gained during the last month or so.

Given the severity of this recession, it is – frankly speaking – somewhat surprising that global stock markets have not lost more than something like 15% since mid-February. Stock markets seem disconnected from the real economy. Why?

Of course, stock markets are forward looking and all that. And, yes, luckily, it seems that the corona virus is on retreat. These are very good news and give some hope. But, given the depth of the recession, I think it will leave scars. It will take time before unemployment in the US reaches 4% again, as an example.

The reason why stock markets in many countries have done great during the last month, when economy activity has suffered like never before, is actually rather simple. Central banks exercised the “central bank put”.

Central banks were every fast to enact even very large rescue packages. They started doing so in mid-March. This helped stabilize financial markets, depress yields, and flooded markets with liquidity. The goal, of course, was to support the real economy. It saved stock markets, too. Shortly after the announcement of all these comprehensive measures, the stock market started rising.

With lots of liquidity around, and low yields everywhere, markets convinced themselves that central banks would save the world. Markets bought stocks, and stock markets surged.

This is what I believe explains it. Otherwise, I cannot make sense of the fast rebound in the stock market. But I do believe markets have thereby become somewhat disconnected from the real economy. And this is strange to witness.