Has the lockdown been too strict and have we paid too high a price (in terms of forgone economic activity) as a result? Evidence from Denmark and Sweden helps answering this important question.

The fact that the number of deaths associated with Covid-19 falls in many European countries is unbelievably good news. As a result, European economies are opening up again. This is also good news. What is perhaps somewhat surprising, though, is that the number of deaths and new cases has not started climbing after opening up. This raises the question whether too many sectors were shut down and we, consequently, paid too high a price to contain the virus. Evidence from Denmark and Sweden suggests that the price was probably not as high as one might intuitively have expected.

Covid-19 in Denmark

The Danish prime minister announced the lockdown of Denmark on March 11. Death numbers kept climbing until early April, but has fallen steadily since then, as this figure shows

Data source: Statens Serum Institute. https://en.ssi.dk/

The fact that Covid-19 seems to be under control in Denmark is obviously very good news.

The lockdown has been costly, though. Jobs have been lost, firms have closed down, incomes have fallen, etc. Public debt levels will increase significantly.

Denmark started opening up again in mid-April. On April 14, private corporations that had been asked to encourage people to work from home were now encouraged to let workers return to their offices, subject to suitable safety measures. On April 15, kindergartens and lower primary schools opened up, and on April 20, hairdressers, dentists, etc. were allowed to open. If the lockdown helped contain the virus, one would have expected to see a rise in deaths and new cases after easing the lockdown. This has not happened.

On May 11, retail shops opened. On May 18, restaurants. Again, if the lockdown was the primary reason why the virus stopped spreading, we should have seen the number of new cases increase after opening up. This we have (luckily) not.

Given that the number of deaths and new cases has been constantly falling since opening up, one may wonder whether the lockdown was too strict. It seems that voluntary social distancing, avoiding large crowds, and the washing of hands have been perhaps even more important. Doctors and scientists wonder whether the virus has mutated and turned less infectious, or warmer weather in April and May has caused a slowdown in new cases, but if I understand what they are saying, they believe that hand washing (and related precautions) is a main reason why numbers fall.

If this is true, we need to ask the question whether it was necessary to keep children and workers at home and close down as much as we did. Whether the economic costs have been too high. This is a sensitive and difficult question, though, because it requires that we evaluate how much economic activity would have fallen had we not shut down as much as we did. Surely, people would have cut consumption anyhow, as people would have been afraid of the virus itself and its consequences. So, what was the extra price we paid because of the lockdown?

Evidence from a clever study

A clever study (Link) by University of Copenhagen researchers Asger Andersen, Emil Hansen, Niels Johannesen, and Adam Sheridan helps us answering this question.

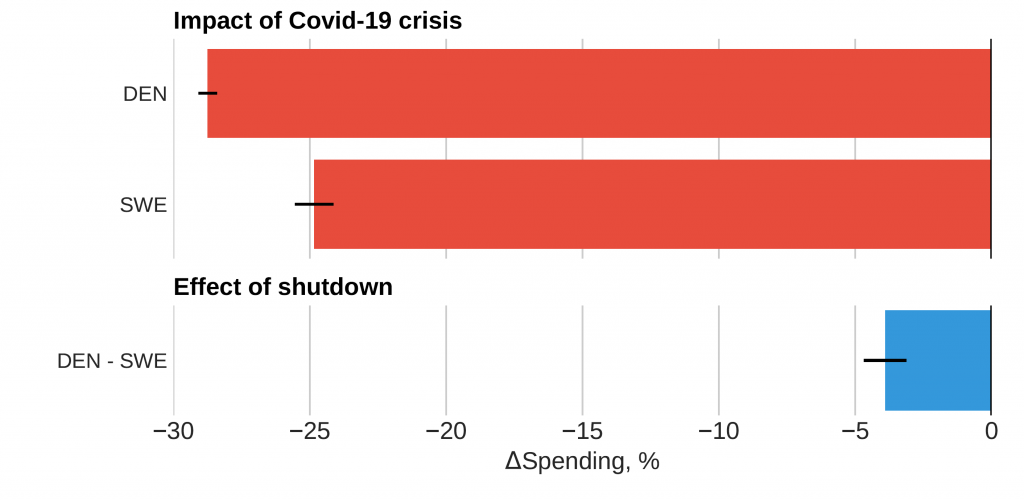

Asger, Emil, Niels, and Adam compare spending by Danes and Swedes. Denmark and Sweden are similar along many dimensions, but have followed different strategies when it comes to Covid-19. Denmark enforced a strict lockdown, as mentioned, whereas Sweden has kept primary schools, restaurants, bars, etc. open (though did close universities and encouraged working from home). If the lockdown was the main cause of the recession, economic activity should have suffered more in Denmark than in Sweden. Andersen et al. use individual bank-account data from a large Danish bank that operates in both Denmark and Sweden (Danske Bank) to address this question. They track spending of 860,000 individuals before and during the lockdown, studying their use of cards, cash withdrawals, mobile wallets, etc. They compare spending of Danes and Sweden from mid-March (when Denmark shut down) through early April. This figure contains their most important result:

The figure shows that spending of Danes fell 29% compared to a hypothetical spending path without the Covid-19 pandemic. A 29% contraction is enormous. But, and this is the main point, spending by Swedes fell by almost as much, 25%. This means that Danes cut spending by “only” 4%-points more than Swedes. Swedes could continue visiting restaurants, schools, etc., but Swedes cut spending dramatically nevertheless. The causal effect on spending, resulting from the extra lockdown in Denmark, is 4%-points and considerably smaller than the effect of the virus itself.

One may debate whether 4% is a small or a large number. In normal times, we would say that a 4% drop in aggregate spending is large. The main cause of this recession, at least according to this study, was not the lockdown, though, but the virus. In other words, even if economies had not been shut down as much as they were, the contraction in economic activity would still have been very large.

The broader picture

The paper by Andersen et al. weighs in on an important debate about the underlying cause of this recession. Is it due to a reduction in supply or demand? Their results indicate that the demand effect is the important one. Spending drops even when supply is less constrained.

But the strict lockdown in Denmark did cause an extra 4%-point drop in spending. Was it worth it? Nobody knows, but research from the MIT (Link) on the 1918 pandemic indicates that areas in the US that took more drastic measures early on, in terms of social-distancing measures and other public health interventions, had stronger recoveries after the measures were eased. There is debate how strong this result is, though (Link).

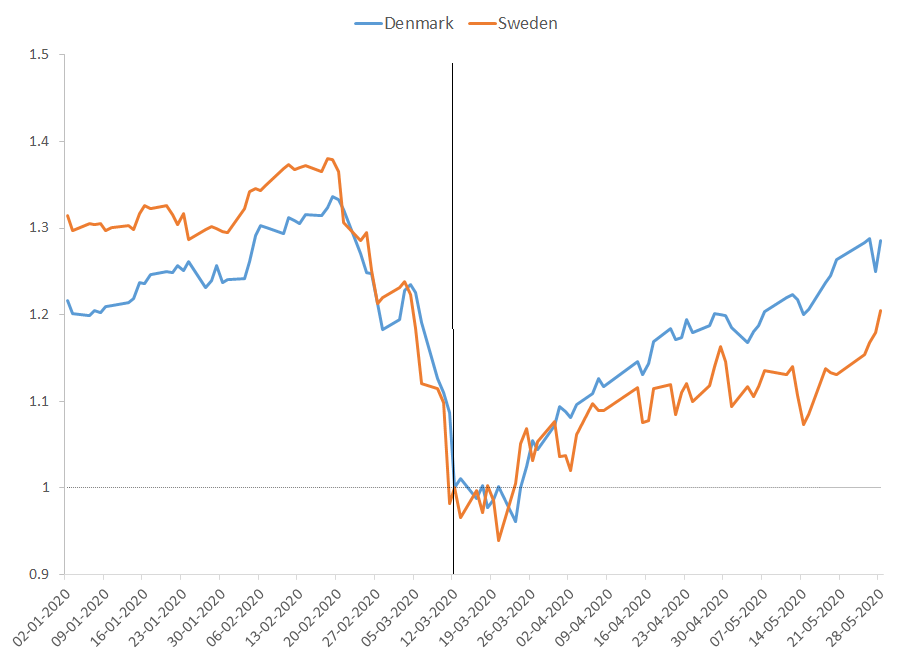

If all this is true, i.e. that the lockdown was not the main cause of the recession, but the main cause was the virus itself and the fear it created, and that the recovery is stronger afterwards in countries that imposed stronger interventions, we should see forward-looking measures indicating this. Early data from the Danish and Swedish stock market seem to point in this direction, even if the evidence is admittedly very tentative and a fuller analysis is obviously needed. This figure shows the Danish and the Swedish stock markets surrounding the date of the lockdown.

Data source: www.nasdaqomxnordic.com

I have normalized the two stock-market indices to “1” on March 12, the day after the lockdown was announced in Denmark. The Danish and the Swedish stock markets followed more or less similar paths during March, but, since then, the Danish stock market has gained 29% whereas the Swedish market has gained “only” 20%. Again, one needs a more detailed analysis (the Danish stock market is heavily influenced by pharmaceuticals and other defensive stocks that do relatively well in downturns), but this early evidence indicates that stock market investors are more positive on the Danish stock market.

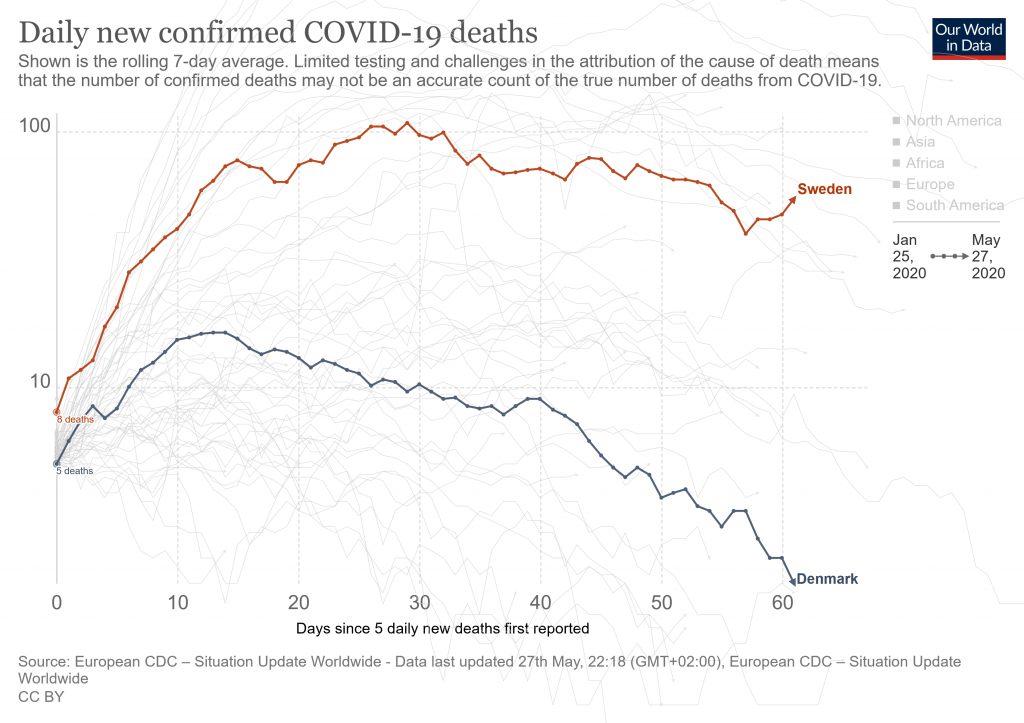

Furthermore, the number of deaths is currently much lower in Denmark than in Sweden (also on a per capita basis), which is of course also something to remember:

Denmark and Sweden vs. other countries

The idea of using credit-card and other payment-type information is great and has been used by a number of economists to obtain real-time information on the economic impact of Covid-19. Microdata indicate that consumer spending in France fell by 50% as a result of the virus (Link), in Spain by 50% (Link), and in the US by something like 50%, too (Link). It thus seems that the contraction in spending is somewhat smaller in Denmark and Sweden compared to other countries. The comments above should be viewed in this light.

In any case, a 30% or 50% drop in spending is a huge drop. But, a 50% drop in spending does not mean that overall economic activity drops by 50%. Overall economic activity includes public spending, exports/imports, etc. So, credit card transactions provide useful information about consumer spending, but cannot stand alone when judging overall economic activity.

Conclusion

At some stage, we need to evaluate carefully whether too much was shut down. Not to blame somebody, but to learn. It is important that we analyze thoroughly whether it is better to be very aggressive early on in a pandemic or whether less aggressive measures are enough. Currently, it seems that we shut down a little too much (and we are now too slow in opening up e.g. borders again), but that the price of doing so was not as high as one might have expected intuitively.