The Nordic countries have different monetary policy regimes. Despite these differences, inflation before and after the pandemic was broadly similar: low inflation before, rising inflation afterwards. However, the countries’ exchange rates behaved very differently. These developments raise the issue of the benefits of fixed exchange rates versus the benefits of maintaining monetary policy independence via floating exchange rates.

In a recent paper, published as part of a report on “Economic Policy beyond the Pandemic in the Nordic countries”, I examine whether the choice of monetary policy regime matters, in the context of the Nordics (Chapter 5 in the report: link). Here, I copy my main findings and present an abbreviated version of my chapter.

My motivation for writing the paper is that the Nordic countries are similar in many respects – generous welfare systems, large public sectors, high levels of trust in society, etc. – but have chosen widely different monetary policy regimes. This leaves for an interesting comparison.

Iceland, Norway and Sweden have floating exchange rates and their own inflation targets. Finland has no legal tender of its own but uses the euro, for which the European Central Bank has a supranational (eurozone) inflation target. Denmark pegs its exchange rate to the euro but has no inflation target.

As a result, the Nordic Region is a unique setting in which to analyse the economic effects of different monetary policy regimes while considering other macroeconomic characteristics.

Inflation

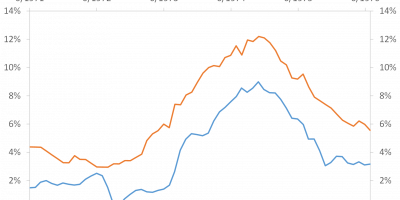

Figure 1 shows inflation in the Nordic countries during the past decade.

Figure 1. Inflation (annual percentage changes in consumer price indices) in the Nordic countries, January 2013 – March 2024. Source: Datastream via Refinitiv and J. Rangvid.

The overall conclusion from Figure 1 is that inflation before, during and after the pandemic was broadly similar. This means that regardless of whether a Nordic country had no currency of its own (Finland), a fixed exchange rate (Denmark) or an inflation target (Iceland, Norway, Sweden), inflation fluctuated around 2% before the pandemic, only to surge to close to 10% afterwards. No Nordic country, regardless of its monetary policy regime, was able to prevent the post-pandemic inflation surge. This is an important conclusion.

During 2023, inflation began to fall in all of the Nordic countries. In March 2024, inflation was 0.9% in Denmark, 2.2% in Finland, 4.1% in Sweden, 3.9% in Norway and 6.8% in Iceland.

You could argue that it is not surprising that inflation behaved similarly in all countries, regardless of whether they have fixed or floating exchange rates, since this burst of inflation was global. I would not disagree with that conclusion. But that does not change the point: countries with independent monetary policies (which can react independently to shocks) did not fare any better than countries that do not have the ability to react to inflation shocks. In this inflation outbreak, it simply did not matter what monetary policy regime you followed.

Exchange rates

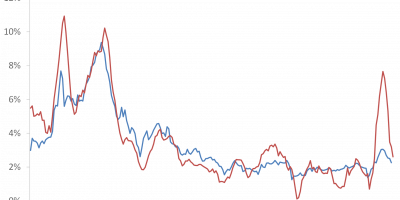

While inflation rates have moved in a similar way across the Nordic countries, exchange rate movements have been very different. Figure 2 shows the exchange rates to the euro for the Danish krone (DKK), the Norwegian krone (NOK), the Icelandic króna (ISK), and the Swedish krona (SEK).

Figure 2. Number of Danish kroner (DKK), Norwegian kroner (NOK), Icelandic krónur (ISK, right-hand scale) and Swedish kronor (SEK) per euro, January 2013 – March 2024. Source: Datastream via Refinitiv and J. Rangvid.

While the Danish krone has been completely stable against the euro for the past decade, the value of the Icelandic króna has been something of a rollercoaster. At the same time, the Swedish and Norwegian currencies have been depreciating persistently. The Norwegian krone has lost more than 50% against the euro during the past decade, while the Swedish krona has lost 30%.

So, while the choice of monetary policy has not mattered for inflation, it has mattered tremendously for exchanger rates.

You could argue that it is only natural that countries with floating exchange rates have more exchange rate fluctuations than countries with fixed exchange rates. That’s almost tautological, so I would not disagree. What is surprising, however, is how large the differences in exchange rates have been, not least because inflation differentials have been so small. The Swedish krona has lost 30% of its value, while the Norwegian krone has lost 50%. That is a huge loss in the value of your money.

Output stabilization

An argument for eliminating exchange rate flexibility is that doing so stimulates international trade, with potentially positive implications for productivity growth. A disadvantage of a fixed exchange rate regime is that monetary policy cannot be used to respond to an asymmetric macroeconomic shock because monetary policy must be geared towards ensuring that the exchange rate remains fixed.

This means that, in a country with a floating currency, the interest rate and exchange rate may be adjusted in response to asymmetric shocks. These countries pay an insurance premium for this, in the form of the generally higher level of exchange rate volatility and its presumed negative impact on the amount of foreign trade.

Specifically, Iceland, Norway and Sweden can change monetary policy rates to account for an asymmetric shock. The “cost” they pay is higher exchange rate variability. On the other hand, Denmark and Finland cannot actively use monetary policy should an asymmetric shock occur. Their gain is lower exchange rate variability. A consequence of this should be that output variability is higher in countries with fixed exchange rates, because they cannot use monetary policy to respond to shocks, whereas countries with flexible exchange rates should experience lower output variability because the exchange rate can act as a shock-absorber.

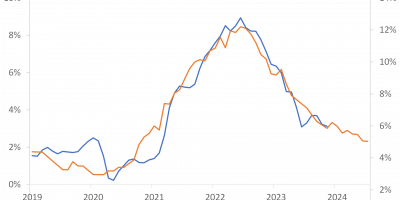

Figure 3 shows annual growth rates of real GDP.

Figure 3. Annual growth rates in real GDP in the Nordic countries, 1999-2022. Source: IMF and J. Rangvid.

The main impression from Figure 3 is that there is no clear relationship between the exchange rate regime and economic volatility and contractions during crises, such as the financial crisis and the pandemic: Denmark and Sweden had practically the same contractions despite different exchange rate regimes. Hence, an independent monetary policy did not act as a shock absorber for Sweden, at least when compared to the impact of the crisis on output in Denmark.

In the paper (chapter 5 here: link) I look at other outcomes, such as interest rates, Quantitative Easing, current account balances, etc. Overall, the conclusion remains that there is no clear link between exchange rate changes or their volatility and other macroeconomic variables. This conclusion is a reiteration of the classic statement by Flood and Rose (1995, link) and Rose (2011, link) that “there is no clear tradeoff between reduced exchange rate volatility and macroeconomic stability”.

Takeaways

My analysis leaves room for some clear takeaways.

First, no Nordic country – regardless of monetary policy strategy – has been able to prevent the post-pandemic inflation flare-up. In every Nordic country, no matter whether it has an inflation-targeting or an exchange rate-targeting regime, inflation increased to around 10% after the pandemic. This indicates that in the face of a global inflation shock, no monetary policy goal is superior to any other. This is an important conclusion.

Second, exchange rate developments have been very different. Neither Denmark nor Finland had exchange rate volatility towards the euro. However, the Swedish and Norwegian currencies have consistently depreciated against the euro over the past decade, while the Icelandic króna has fluctuated significantly.

Third, it might be expected that countries with floating exchange rates would have lower output variability because one reason for choosing a floating exchange rate is that it can function as a shock absorber and allow monetary policy to be geared towards domestic stabilisation. However, there is no strong empirical evidence to back up this hypothesis, at least over the past several decades in the Nordic countries.

Conclusion

The main conclusion of my analysis is that despite different monetary policy regimes in the Nordic countries, inflation (the ultimate target of monetary policy) has been broadly similar.

It is relevant to recall that Denmark pegs its exchange rate to the eurozone, which has an inflation target of 2%. By doing so, Denmark is essentially “importing” a 2% inflation target. While this is true, the choice of an exchange rate target or an inflation target is still a politically sensitive issue. For instance, arguing that Denmark could abandon its fixed exchange rate policy because it could achieve the same inflation outcome with a floating exchange rate may be empirically correct, but it is fraught with political and economic considerations. Similarly, arguing that Norway and Sweden could just as well peg their currencies to the euro is also a politically sensitive topic, even if it achieves the same outcome in terms of inflation and other macroeconomic variables.

The general conclusion of my analysis naturally leads to the – possibly somewhat provocative – conclusion that the benefits of a floating exchange rate are unclear. Equally provocatively, aside from reduced exchange rate variability, it is not clear what the benefit is of giving up monetary policy independence by fixing the exchange rate. Based on the evidence of recent decades, there is no clear “winner” when it comes to the choice of monetary regime in the Nordic countries. If anything, it seems difficult to make a strong case for floating exchange rates, as the countries with such systems have had neither lower inflation than the countries without exchange rate flexibility nor lower variability in output, but much higher variability in exchange rates. However, who knows whether the possibility of exchange rate changes and of pursuing an independent monetary policy (which Iceland, Norway and Sweden have) might prove useful one day?

If you can read Danish, the Danish business newspaper Borsen published a larger article on my analysis: link.