The corona crisis has caused a loss of economic activity. To calculate the total economic cost of this health-induced crisis, we must factor in health-related costs. Based on calculations for the US by Cutler & Summers, this post calculates the economic cost of the crisis in Denmark. Many uncertainties surround such calculations, and I discuss those. It seems a robust conclusion, though, that the cost of the crisis in Denmark will be considerably smaller than the cost of the crisis in the US. The broader implication of this result is that there is considerable variation across countries in the economic cost of the pandemic.

Economic activity suffered dramatically during spring, and it will take time before economic activity has recovered to its pre-crisis growth trend. In addition to the loss of economic activity, we must take into account health-related costs, if we want to estimate the total economic cost of the crisis. This is no easy task. Inevitably, it will be based on a number of assumptions. In a recent Journal of the American Medical Association article, Harvard University Professors David M. Cutler and Lawrence H. Summers (link, link) present a calculation of the total economic cost of the corona crisis in the US. Their calculation takes into account both the cost of lost economic activity as well as the economic value of premature mortality, the economic value of health impairments, and the economic value of mental health impairments.

Cutler & Summers (CS) find huge economic costs of the corona crisis in the US. They estimate the economic cost at USD 16 trillion. This is 90% of US GDP. This exceeds the cost of the financial crisis in the US by a wide margin, Cutler & Summers argue.

This post presents the first calculations of the cost of the crisis in Denmark. I follow the procedure of Cutler & Summers, but use Danish data. Knowing results from other countries, we will be able to better judge whether results for the US are globally representative.

I stress that these are first calculations and that uncertainties surround them. But, if we want to have a meaningful discussion of the cost of this crisis, we have to make assumptions, and then discuss their robustness. I do so.

Lost GDP

The first component of the calculation of the economic cost of the crisis is loss of economic activity. CS look at forecasts for US Gross Domestic Product from the Congressional Budget Office right before the crisis and compare it with the latest forecasts. The difference is the loss of economic activity. CS calculate a loss of USD 7,600bn. This corresponds to 35% of US pre-crisis GDP.

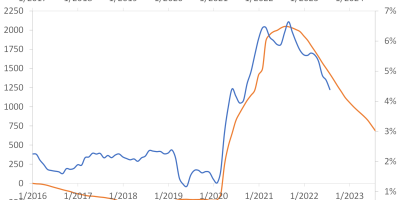

In Denmark, the Danish Economic Councils publish independent forecasts for Danish GDP. In their latest autumn 2020 report, the Councils publish figures for the expected development in structural Danish GDP, had there been no corona crisis. They also estimate expected GDP as of now. The results are here:

Danish GDP forecasts. DKK billions. Autumn 2020 forecast (“GDP”) vs. expected path of structural Danish GDP assuming no corona crisis.

Source: Danish Economic Councils

The difference between now-expected GDP developments and expected GDP developments without the corona crisis is the loss of Danish economic activity due to the crisis. This amounts to DKK 214bn (app. USD 40bn) for the years between 2020 and 2024, when Danish GDP is assumed to have recovered to its without-corona crisis structural trend. This loss of economic activity corresponds to approximately ten percent of Danish 2019 GDP.

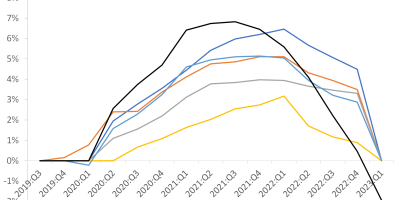

One reason why the loss of economic activity in Denmark is expected to be considerably smaller than the loss in the US (10% in Denmark vs. 35% for the US) is that the Congressional Budget Office (CBO) expects the loss of economic output to persist in the US. CS reproduce this figure from the CBO:

US GDP forecasts. July 2020 forecast vs. January 2020 forecast.

Source: Cutler & Summers (2020).

Even ten years out, in 2030, US GDP is expected to be lower than its pre-crisis expected growth path. This is different in Denmark. In Denmark, the most recent forecast indicates that economic activity will have recovered in 2024. This reduces the loss of GDP in Denmark, relative to the US.

Cost of premature mortality

Deaths add to the economic cost of the crisis. CS note that 190,000 Americans had passed away due to Covid-19 by late September 2020. This is 0.06% of the US population.

In late September, when CS wrote their report, 5,000 Americans passed away per week as a result of Covid-19. CS expect this to continue for another year, i.e. an additional 260,000 deaths. CS estimate excess non-Covid-19 deaths at 40% of Covid-19 deaths. This means 1.4 x 450,000 = 625,000 American deaths.

In the US, a statistical life is estimated at USD 10m. CS reduce this by 30% to be conservative. All in all, this results in an economic costs of USD 4.4 trillion due to premature mortality. This is 20% of US GDP.

In Denmark, 816 have passed away as a result of COVID-19, at the time of writing this post (early December). In late September (to compare with the CS US figures), 650 had passed away. This is 0.01% of the Danish population.

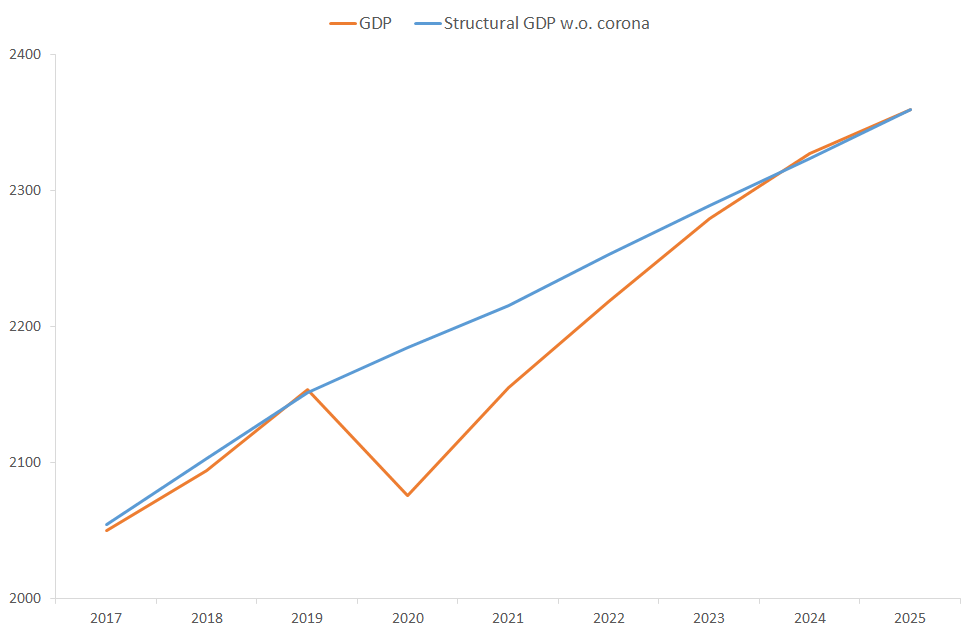

This figure shows daily deaths due to Covid-19 in Denmark since March 2020:

Daily Covid-19 associated deaths in Denmark.

Source: https://en.ssi.dk/.

During the last couple of weeks, around 25 Danes have passed away because of Covid-19. Assuming, like CS, that this will continue for another year, this accumulates to 1,300 additional deaths. Assuming 40% excess non-Covid-19 deaths, like CS, results in 2,900 deaths over the next year.

In Denmark, a statistical life is estimated at DKK 34m (link). This corresponds to app. USD 5m. In other words, the value of a statistical life in Denmark is only half the value of a statistical life of an American. To be conservative, like CS, I use 70% of this. This gives an economic cost resulting from premature deaths of DKK 79bn. This is around 4% of Danish GDP. I.e., again, the loss in Denmark seems to be considerably smaller than the comparable loss in the US (4% of GDP vs. 20% of GDP). This is because fewer Danes are expected to pass away because of Covid-19 and because the value of a statistical life is assumed to be considerably smaller in Denmark.

Health impairments

Some of those surviving Covid-19 will face significant long-term health complications. CS mention that there are approximately 7 times as many survivors from severe or critical Covid-19 diseases as there are Covid-19 deaths, and that a third of these will experience long-term complications. CS assume that the cost of this is 35% of a statistical life and that it lasts for one year. This adds USD 2.6 trillion, or 12% of US GDP.

In Denmark, using the procedure of CS, expect 2,100 deaths, as mentioned above. This means 4,900 individuals with long-term health impairments over the next year. Assuming that the complications last for one year, and assuming an economic cost of complications of 35% of a statistical life, this means an economic loss of DKK 41bn, or 2% of GDP. Notice, like CS, I use the conservative value of 70% of a statistical life, i.e. 35% of 0.7 x 34m.

Mental health impairments

Many people get anxious or fell depressed during the pandemic. This could be because people need to isolate at home, and thus face loneliness, because of fear of losing your job, i.e. economic insecurity, fear of contracting the virus, etc. CS report that 40% of American adults have reported symptoms of depression or anxiety during the corona crisis. Normally, CS report, 11% of Americans report these symptoms. CS report that previous studies evaluate the one-year cost of depression and anxiousness at USD 20,000 per case. This amounts to an additional cost of USD 1.6 trillion, or 7.5% of US GDP, for the corona crisis.

In Denmark, we do not have official data on the number of people feeling anxious or depressed during the corona recession. What we do have, on the other hand, is the comprehensive health report of the Danish population from 2015 that also estimates the economic costs of a number of diseases in Denmark (link).

This report mentions that 136,000 Danes suffer from anxiousness and 91,000 from depression (in 2012). In total, around 4% of the Danish population. The report calculates an aggregate cost of lost economic activity of DKK 8.6bn for anxiousness and DKK 3bn for depression, primarily as a result of early retirements. These costs relate to 2012. Since then, inflation has been 7% in Denmark, i.e. the 2020 value is DKK 12.4bn (app. USD 2bn), assuming the same number of depressed and anxious individuals. CS assume an almost fourfold increase in the number of individuals facing depression and anxiousness because of the corona crisis. Given that this number is associated with a large degree of uncertainty in Denmark, and because one might hope that many people will recover, as this is a temporary crisis, such that not all of them will enter into early retirement, I double this number (in contrast to CS who assume a fourfold increase). I.e., I assume that the economic cost of mental health impairment amounts to DKK 24bn (app. USD 4bn), or app. 1% of Danish GDP.

Total costs

In total, taking into account the loss of economic output as well as health costs, reflecting both premature deaths, long-term health impairments, and mental health impairments, the economic cost of the pandemic in Denmark amounts to DKK 336bn, or 16% of Danish GDP:

This corresponds to approximately DKK 60,000 per Dane (app. USD 10,000). For a family of four, this means that the economic cost of the crisis is app. DKK 240,000 (app. USD 40,000).

Implications

A number of implications follow from these calculations:

- A cost to society of 16% of GDP is an enormous cost.

- With this in mind – that a 16%-GDP cost is enormous – it also follows immediately, on the other hand, that the cost of the pandemic in Denmark is considerably smaller than the cost of the pandemic in the US. CS find, as mentioned, that the cost of the pandemic in the US will amount to 90% of US GDP. For Denmark, I find it will be 16% of Danish GDP. This implies that there is considerable variation across countries in the expected cost of the pandemic. Or, in other words, that it would be a mistake to assume that the cost of 90% GDP found for the US is a globally representative figure.

- There are several reasons why the cost of the pandemic is considerably lower in Denmark:

- Danish GDP is expected to recover faster than US GDP. Danish GDP is expected to have recovered in 2024. On the other hand, US GDP is not expected to recover (reach its pre-crisis growth trend) within the next ten years. This implies a larger negative effect of the pandemic on the US economy.

- Fewer individuals have passed away in Denmark due to the pandemic. In late September, 0.06% of the US population had passed away. In Denmark, “only” 0.01% had passed away. This reduces the cost of premature mortality in Denmark.

- The value of a statistical life is lower in Denmark. According to CS, in the US, it is USD 10m. In Denmark, it is USD 5m. This also reduces the cost of premature mortality in Denmark.

- The numbers indicate that fewer people in Denmark will face health impairments, compared to the US. This also reduces the economic costs in Denmark, compared to the US.

- CS find that the cost of the pandemic exceeds the cost of the financial crisis by a large margin. In 2012-2013, I chaired the official committee investigating the causes and consequences of the financial crisis in Denmark (link). We found that the financial crisis – at the time of writing the report in 2013 – had caused a DKK 200bn reduction in GDP. In 2008, when entering the financial crisis, Danish GDP was DKK 1,800bn, i.e., the accumulated loss up until 2013 amounted to 11% of pre-financial crisis GDP. Given that Danish GDP had not recovered to its pre-crisis trend in 2013, the final loss of the financial crisis is larger. It seems that the economic cost of the financial crisis and this pandemic will be, more or less, equal.

Uncertainties and assumptions

Many uncertainties surround the calculations presented above. In this section, I discuss some of them and their consequences. Notice as a starter, though, that by relying on the assumptions of CS above, I am able to compare results for Denmark with results for the US. If using other assumptions than CS, this is less straightforward. This – that it is easier to compare across countries when using the same underlying assumptions – is an argument for using the CS assumptions. Nevertheless, to see how sensitive results are, let us discuss what happens if using other assumptions.

Will Danish GDP have recovered in 2024, as the Danish Economic Councils expect? If not, the cost will be higher. If sooner, the cost will be lower.

Will 25 Danes pass away per week over the next year? This seems like a high number these days, given that we expect vaccines to be ready within the next few weeks. If “only” 650 (i.e. half the assumed number in the base-line calculations) additional Danes pass away, the cost of premature mortality will be reduced from DKK 71bn to DKK 49bn, and, all other numbers equal, the total cost will be reduced to DKK 300bn, or 14% of GDP. I.e., the baseline calculation is reasonably robust towards this adjustment.

The cost of mental health impairments in Denmark is associated with considerable uncertainty in this calculation, as we do not have official numbers for how Danes have been affected by depression and anxiousness during this pandemic. The overall baseline calculation is reasonably robust towards this number, though. For instance, I double the 2012 number in the baseline calculation. If I multiply with three, i.e. assume even more people are affected by mental health challenges, the total cost increases from 16% of GDP to 17% of GDP.

Finally, I, like CS, assume that the cost of premature deaths is 70% of the value of a statistical life. More than half – 52% – of Covid-19 related deaths in Denmark have been above 80 years old. Even when I, like CS, mark down the value of a statistical life by 30%, the number might still seem high. Reducing this further would of course lower the total cost of the pandemic marginally.

Conclusions and policy implications

This post presents first calculations of the expected economic cost of the Covid-19 pandemic in Denmark. Taking into account the direct effects on GDP, as well as the economic value of premature deaths and health consequences, I expect the economic cost of the pandemic to be 16% of Danish pre-crisis GDP. The calculation is based on a number of assumptions, but the overall figure seems robust to reasonably variations in these assumptions.

Harvard Professors Cutler & Summers expect that the cost of the pandemic in the US amounts to 90% of US GDP. The cost in Denmark will most likely be considerably smaller. Only a fifth of the cost in the US. This is due to a faster economic recovery in Denmark, a lower number of deaths in Denmark, a lower value of a statistical life in Denmark, and lower associated health costs. This large difference between the US and Denmark implies that there is considerable cross-country variation in the cost of the pandemic.

Cutler & Summers argue that the cost of this pandemic will exceed the cost of the financial crisis in the US. In Denmark, it seems that the cost of this pandemic will correspond, more or less, to the cost of the financial crisis.

Even when the cost of the pandemic in Denmark is considerably lower than the cost in the US, the cost is still enormous. 16% of GDP is a very large figure. For a family of four, it corresponds to DKK 240,000 (app. USD 40,000).

When the cost is high, it becomes even more important to roll out vaccines as fast as possible, as soon as health authorities have approved them. Call in retired doctors, call in retired nurses, use all available working personnel, and pay them all handsomely to work 24/7 in order to vaccinate as many as possible as quickly as possible, from a health perspective and an economic perspective. This will help contain the already very high cost of this pandemic.