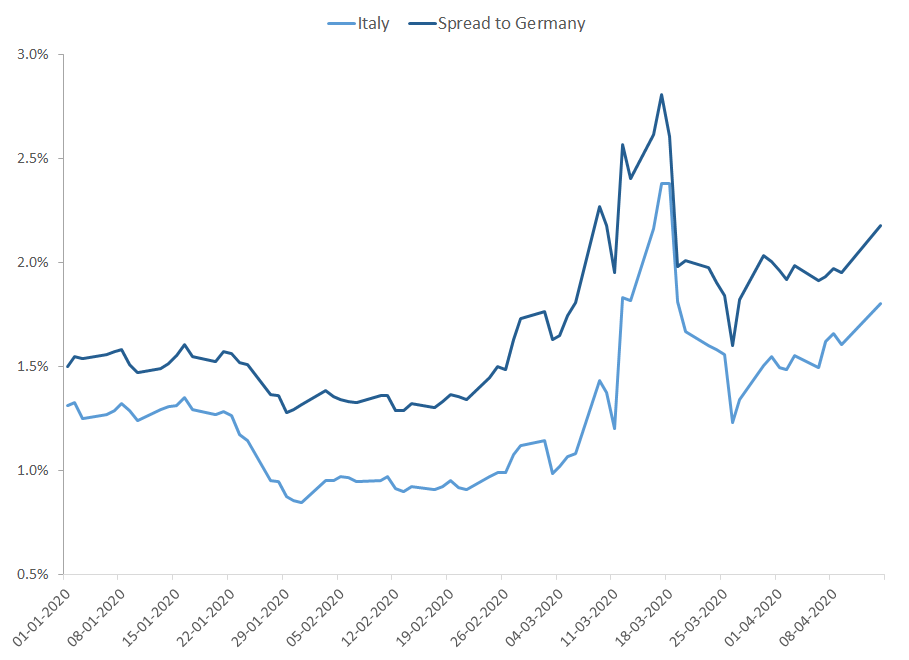

Fear of a new Eurozone debt crisis, similar to the one in 2010-2012, resurfaced in March. Within a week or two, Italian yields more than doubled. Given Italy’s large stock of sovereign debt, nervousness increased. Since then, yields have come down and markets stabilized somewhat. A key difference to the European debt crisis of 2010-2012 is that yields on “safe” assets, like German and US yields, rose, too. What happened and will calm remain?

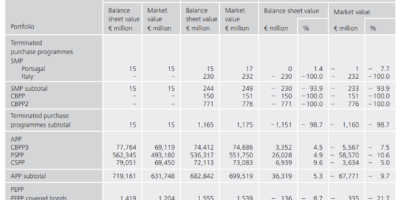

First, the facts. This figure shows Italian yields (yield on a ten-year sovereign bond), as well as its spread to the German ten-year government bond yield, from the beginning of the year through April 14. The spread to German bonds is larger than the Italian yield itself because German yields are negative (see below).

Data source: Datastream via Thomas Reuters Eikon.

Bond markets were calm in the beginning of the year, only to explode from March 3 through March 18. On March 3, the Italian benchmark yield was one percent. On March 18, it was 2.4 percent. Similarly, the spread to German yields rose. Given the speed of the adjustment, and the size of Italian government debt, this is worrisome. It reminds us of the situation in 2010 where yields on debt from Italy and other southern European countries rose sharply. There are, however, additional ingredients to the story this time.

The worry with Italy is that it will face difficulties remaining solvent if its yields rise. And, given the size of the Italian debt mountain, it will be difficult for the Eurozone to bail out Italy. It is also a story of disastrous communication by the new ECB chief Christine Lagarde, who at the ECB Press conference on March 12 said the by-now famous words “We are not here to close spreads”, meaning ECB will not come to the rescue of Italy. Many of us wonder why Italy has not tried to stabilize its finances since the European debt crisis, but this was not the right time to raise this point. Italy was in the middle of the terrible corona crisis and markets were nervous. The remark of Lagarde should have been saved for another day. Markets tail-spun.

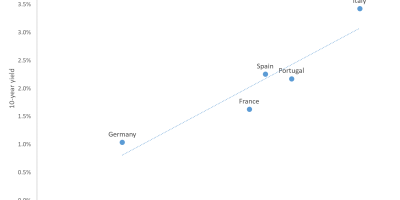

This time around, however, there is an additional element to the story. Something unusual happened in other bond markets. Look at this graph.

Data source: Datastream via Thomas Reuters Eikon.

It shows yields on ten-year sovereign bonds from a number of countries. Italian rates spiked, as mentioned. However, and this is the curios fact, rates of what is typically viewed as safe-haven bonds also rose dramatically.

German yields rose from their low of minus 84 basis points on March 9 to minus 17 basis points on March 19, an increase of more than sixty basis points. The same goes for Danish and Dutch yields. Denmark, the Netherlands, and Germany are Triple-A rated. Even US yields more than doubled, from fifty basis points to 126. A rise of eighty basis points in US yields within a week or so is very dramatic. It is also very different from what we typically see during times of crises. Typically, in crises, investors sell risky assets and buy bonds of safe-haven countries, causing their yields to fall. This did not happen in March. If safe assets lose value during crises, where should investors seek shelter?

So, this is a story about Italy and a reassessment of the credit risk of Italy. But it is more than this because otherwise safe havens saw yield rose, too, exerting an additional upward pressure on Italian yields.

From early March to mid-March, Italian yields rose by almost 150 basis point. The yield spread to Germany “only” rose by 100 basis points. The difference is the rise in German yields.

This BIS Bulleting provides an interesting account of what caused the rise in US yields during early-mid March. They only look at the US, but probably some of the same factors caused the effects in Germany. BIS argues that hedge funds and other levered investors were forced to sell because of margin calls. “Leverage” means that you borrow to invest and “margin calls” means that you have to come up with extra money when the assets you have bought for borrowed money fall in value. So, when you have borrowed a lot to invest (you are highly leveraged), you will face large margin calls. In this case, you have to sell many assets to generate a lot of cash you can pledge as security. If markets function “perfectly”, dealers will be able to absorb the sales and build up inventories. Prices should be unaffected. But if dealers cannot absorb the sales, for instance because dealers are subject to capital requirements and cannot raise capital immediately, then there is nobody out there to buy and prices of bonds fall and yields rise. BIS argues that these events had spillover effects on other types of investors causing them to sell bonds, too. I.e. a lot of investors had to sell, causing such a big effect. In their FSR, IMF is aligned.

More broadly, BIS argues, these events imply that central banks might need to employ different tools from what they have been used to during previous crises (buy bonds from dealers instead of providing liquidity). The events also imply that a different composition of sovereign bond investors (leveraged private investors instead of sovereign wealth funds) could imply different market dynamics during periods of stress.

Where does this all take us? First, I am still worried about Italy. The Italian sovereign debt is huge, and the situation is shaky. Right now, it might look OK. Italian yields are higher than in January and February, i.e. spreads to e.g. Germany have widened, but not by too much, even if the tendencies of the last couple of days might be worrying. Unrest could easily resurface, however. In addition, events in March told us an important lesson about the implications of changes in market structures. If owners of sovereign bonds of safe countries are mainly leveraged private investors, and if dealers cannot absorb large sell-offs, even yields of safe-haven assets might rise during turmoil. This is worrying for investors, as they will then have fewer places to seek shelter during times of stress.

So, Italian yields rose because investors repriced credit risk in Italy and ECB made a blunder. Spreads to Germany rose. But, Italian yields also rose because yields on safe assets (German and US) rose, pushing up all yields. The latter effect is new, and somewhat scary.