At its last meeting (July 21, 2022), ECB made two important decisions: It raised the policy rate and it introduced the Transmission Protection Instrument (TPI). The first decision was uncontroversial, the second not. In this analysis, I describe why the TPI was launched and how it works. I point out positive and negative aspects. Along the way, we will meet fascinating concepts such as self-fulfilling expectations, multiple equilibria, and sunspots. I discuss if such things can be identified in real life.

ECB’s July meeting (July 21, 2022) will go down in history because of two historical decisions.

The first was the 50 basis points hike in the policy rate. It is noteworthy because (i) it was the first rate hike since the financial crisis more than ten years ago, (ii) it was the first time in more than 20 years that rates were hiked by as much as 50 basis points (last time was June 9, 2000), and (iii) it lifted policy rates away from negative territory, as the rate on the Deposit Facility (ECB’s main policy rate) was raised from –0.5% to 0%.

You might wonder if it was a controversial decision. It was not. In fact, this was probably one of the least controversial hikes in ECB’s history, I would argue. Inflation is running at 9%, meaning a hike in rates was desperately needed. The only thing that is controversial – which it then on the other hand certainly is – is that it has taken so long before rates have been hiked. As readers of this blog know, ECB is miles behind the curve. It is thus positive that ECB has finally started to address much too high inflation.

(One may argue that it was controversial that ECB promised markets in June that they would raise rates by 25 basis points at the July meeting, but then nevertheless went for 50 basis points. Forward guidance was abandoned. Given that ECB is miles behind the curve, I will classify this as non-controversial, though we might debate this).

Transmission Protection Instrument (TPI)

The second important decision was the launch of the so-called Transmission Protection Instrument (TPI, link).

TPI allows ECB to buy public sector securities and – “if appropriate”, as ECB states it – private sector securities. Public sector securities are debt securities, with a remaining maturity of between one and ten years, issued by euro area central or regional governments. But let’s call a spade a spade. For all practical purposes TPI opens the door for unlimited purchases of Italian sovereign bonds. ECB President Lagarde indirectly confirmed this (link): “TPI is a programme designed for specific circumstances to address specific risks, but that is available to all countries of the euro area.” This means TPI should not be used by everybody. The intention is that if/when Italy (a specific risk) runs into trouble (a specific circumstance), ECB can buy all their bonds.

And, yes, they can buy “all their bonds”. As it says, “Purchases are not restricted ex ante.” There is no limit to how much debt can be bought under the TPI.

Notice, by the way, I am not the only one calling these decisions historical. Lagarde said: “I think it’s a rather historical moment.”

Why launch the TPI?

ECB is responsible for monetary policy in all euro area member states. Therefore, ECB would like to see its decisions being smoothly transmitted across member states. When ECB raises rates by 50 basis points, it would like to see rates to go up by 50 basis points in all member states.

Alas, this is not what is happening.

Since ECB started expressing doubt that inflation is temporary, yields on sovereign bonds have increased more in some countries (read: Italy) than in other countries. This causes other interest rates (e.g., rates on mortgages, rates on bank loans, rates on corporate loans, etc.) to increase more in those countries as well. Basically, monetary conditions have tightened more in Italy than in Germany. ECB is rightly concerned.

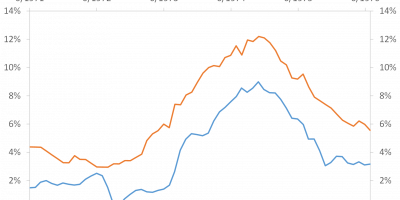

Just so that you know what I talk about, Figure 1 is the updated version of the 10-year Italian-German yield spread during 2022.

Data source: Datastream via Refinitiv.

At the turn of the year, the German 10-year yield was basically 0%. Today it is 1%. The Italian yield has increased even more, though. The 10-year Italian yield is now 2.5 percentage points above the German yield, as Figure 1 shows. At the turn of the year, Italian yields were “only” slightly more than one percentage point above German yields. Clearly, monetary conditions have tightened more in some countries. This is not a smooth transmission of monetary policy across member states.

The Transmission Protection Instrument allows ECB to buy unlimited amounts of Italian (and other) bonds. Such bond purchases can bring down Italian yields, providing for a smooth transmission of monetary policy in the euro area.

The reason for the instrument is understandable. The big question, however, is whether ECB should be responsible for bringing Italian yields down.

Why is TPI controversial?

TPI can be activated to counter “unwarranted, disorderly market dynamics”. If Italian yields rise “too much”, i.e. yield rises are “unwarranted”, ECB can activate the TPI (subject to conditions, see below).

ECB accepts that (link) “differences in local financing [conditions] can legitimately arise. Among other [reasons], due to the country-specific macroeconomic landscape”. This means TPI will not always be activated if Italian yields rise. It will be activated if increases in yields are not – according to ECB – caused by country-specific macroeconomic conditions but caused by disorderly dynamics.

What are “disorderly dynamics”? This is not clear. But it seems to imply situations where investors sell Italian bonds for no good macroeconomic reason, pushing up Italian yields for no good reason. It might be investors displaying bubble-like behavior, i.e. trade on the belief that bond prices will develop in one direction, independently of the macroeconomic situation. It could also be pure speculation, i.e. traders selling Italian bonds to make a profit, but where this profit is unrelated to the macroeconomic fundamentals.

Difficult to identify “disorderly dynamics”

My main worry is that it is difficult in real life to identify when a rise in yields is “fair”, i.e. “warranted”, and when it is “unwarranted”.

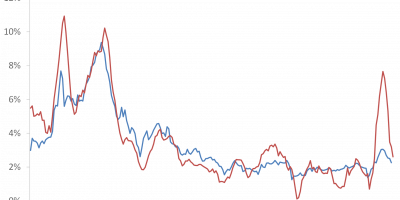

Consider for instance Figure 2 that shows the relationship between the debt-to-GDP ratio and the level of yields (at the time of writing, i.e. late July 2022) in a number of euro area countries.

Figure 2 reveals an almost linear relation between the debt-to-GDP ratio and the level of yields. Countries that have more debt pay higher interest rates. Investors require an extra compensation if they should buy debt of highly indebted countries. This is completely rational and has nothing to do with “unwarranted market dynamics”.

People having worked with empirical asset pricing models – I have – know how difficult it is to determine the theoretical single “right” price of an asset. We have multiple asset-pricing models, multiple estimation methods, and we have uncertainties surrounding estimates of any model. This makes me skeptical that a central bank can determine when a yield is “wrong”. Remember that investors trade at these yields. Saying a yield is “unwarranted” is the same as saying that investors are wrong. Or, more bluntly, that ECB knows better than all the investors out there. I doubt this.

Multiple equilibria

This does not mean that TPI is crazy. I agree that if interest rate movements were clearly caused by non-fundamental factors, a case could be made that ECB should intervene.

Let me explain. Italian yields could rise for perfectly rational reasons, even when nothing has happened to the macroeconomic situation in Italy. This could happen in a situation with multiple equilibria. In such a scenario, a TPI could help investors focusing on the best of several equilibria.

Multiple equilibria as an explanation for abrupt market dynamics was proposed by Berkeley Professor (and former IMF Chief Economist) Maurice Obstfeld (link) as an explanation of the exchange rate crises in the European Exchange Rate Mechanism in the early 1990s. Back then, I was a young PhD student writing my PhD on currency crises. I was inspired by these types of models. I ended up writing a survey of this whole literature (link).

For the current situation, such a model could look as follows. There is a good equilibrium in which Italian interest rates are low and everything is fine. Italy is able to honor its debt, and everybody believes Italy will do so. Investors are happy buying Italian debt at low interest rates. But for some reason – in these models called a “sunspot” – investors suddenly become nervous. They do not want to hold Italian debt. Interest rates in Italy rise. But Italy has so much debt that it will be difficult to honor the debt when interest rates are high. Nobody wants to hold Italian debt when yields are high, and yields rise even further. This makes it impossible for Italy to honor its debt. Another (bad) equilibrium has been realized.

Notice – and this is the whole point in these models – that the level of debt is the same in the two equilibria, i.e. the macroeconomic fundamentals are the same. But the outcomes are very different.

Both equilibria are rational. The only thing that triggers the shift from the good to the bad equilibrium is that people’s expectations have changed, from believing that Italy can honor its debt to believing Italy cannot. When investors believe Italy can honor its debt, they are happy to buy Italian bonds at low yields. But when people do not believe in Italy, they will not buy its debt, interest rates rise, and Italy runs into trouble. This is a self-fulling debt crisis. The crisis is not due to “irrational speculation”, “bubbles”, or the like. It is perfectly rational.

If this – multiple equilibria – is what drives markets, a TPI could make sense. If investors know that ECB will intervene if rates start rising “too much”, given the same set of fundamentals, investors might not change their expectations in the first place. Remember that it is the mere shift in expectations that causes the shift from the good to the bad equilibrium. If investors know that ECB will stand ready to intervene if equilibria should shift, there may never be a shift in expectations/equilibria in the first place.

TPI thus has the potential to reduce the likelihood that expectations shift, for a given set of macroeconomic fundamentals. Or, more directly, the mere introduction of the TPI might imply that there is no need to use it, because it stabilizes investor expectations. In this situation, investors are happy to keep on buying Italian debt because they know that ECB is there to save them should expectations shift. The mere launch of the TPI could mean that ECB might not even have to use it.

Notice that the argument here is the same as the argument for a deposit insurance in the good old Diamond-Dybvig bank-run models (link). If depositors know that somebody guarantees their deposits, they will not run to the bank to withdraw them in the first place.

Ten years ago, during the European debt crisis in the early 2010s, economists argued for exactly this kind of ECB intervention based on multiple equilibria types of arguments (link, link, and link).

Two counterarguments

The first counterargument to this story is of course that ECB might get it wrong.

Given difficulties in estimating the right level of yields, it is easy to imagine a situation where ECB judges that a shift between two equilibria has been realized, and intervenes, but what has in fact happened is that fundamentals have changed.

In a stylized theoretical model, one can uniquely determine when market dynamics are due to shifts between different equilibria given the same set of fundamentals. In the real world, where fundamentals change every day, it is much more difficult. There is a real risk that ECB will intervene even when market dynamics are not “disorderly”, but simply because ECB finds that Italian rates have increased “too much”. And the problem here is that ECB then supports the fiscal stance of one member state but not that of other member states.

This, that ECB directly supports the fiscal opportunities of one country only, is a fundamental challenge.

The second counterargument is that multiple equilibria do not arise out of the blue. A key insight in multiple equilibria models is that multiple equilibria only arise when fundamentals (here debt levels) are sufficiently bad. There are typically three scenarios in these types of models:

- If debt levels are super low, there is only one good equilibrium. Debt is so low that investors believe the government will always honor the debt. Investors will not suddenly start mistrusting the government. There are no multiple equilibria.

- When debt levels are high, but not super high, there are multiple equilibria of the type explained in the previous paragraphs.

- When debt levels are super high, there is only one bad equilibrium. Nobody want to buy the debt and the country defaults.

In other words, even when multiple equilibria could rationalize a TPI, there is an even better solution: Fix the debt level in the first place.

Sound policies needed to activate the TPI

Two criteria must be fulfilled to activate the TPI. First, ECB must judge that yields have increased for “unwarranted” reasons. This, as just explained, is difficult. Second, when ECB has established that yields have increased for “unwarranted reasons”, the country in question must have sound macroeconomic policies. On this I think the ECB has been smart.

ECB will only buy bonds from a country that pursues “sound and sustainable fiscal and macroeconomic policies”. Furthermore, ECB will not be the authority that determines whether a country pursues “sound and sustainable fiscal and macroeconomic policies”. Instead, ECB leaves it to the EU commission, and thus indirectly to politicians. This provides arms-lengths, and I think this is good.

Basically, there are four criteria (link). A country must:

- comply with the EU fiscal framework, basically meaning fiscal deficits cannot be too large,

- not be plagued by severe macroeconomic imbalances;

- be fiscally sustainable. This means the level of debt should be sustainable. To determine this, ECB will rely on EU and IMF criteria;

- have sound and sustainable macroeconomic policies.

So, while it is difficult to determine when interest rate movements are “unwarranted”, I judge it favorably that the country needs to be on a sound path. If macroeconomic policies are not sound, ECB will not come to the rescue.

Conclusion

ECB has finally started to raise policy rates to combat too high inflation in the euro area. Precious time has been lost, and ECB is miles behind the curve, as I have argued repeatedly on this blog, but, at least – finally – ECB has started to combat inflation. This, albeit too late, is good news.

ECB has also introduced a new policy instrument, a Transmission Protection Instrument (TPI). The intention is that it should help securing a smooth transition of monetary policy across euro area member state. Read: If yields rise in Italy, ECB can intervene.

Situations can arise where investor expectations suddenly change, even without material changes in underlying macroeconomic fundamentals. In such situations, TPI can help anchoring expectations and avoid bad equilibria. In fact, the mere existence of a TPI can help eliminate potential jumps from good to bad equilibria. Also, the conditions required to activate the TPI have been well designed.

In real life, however, it is difficult to determine when yields have risen for “unwarranted” reasons. It is easy to imagine situations where yields rise in a country and ECB steps in, even if it actually should not. If this happens, ECB provides direct fiscal support to a single member state. This would be highly controversial. In this sense, the introduction of the TPI is a historical, and controversial, decision.