Central banks argue that they are not profit-seeking institutions and cannot go bankrupt, suggesting that their financial performance does not matter. This contrasts with recent events. ECB reported a profit of exactly zero (0) euros for 2022. Bundesbank basically did the same. This is in line with new research showing that central banks prefer to avoid negative results. And why? Because they fear for their independence. A recent discussion about Bundesbank illustrates this. If the Bundesbank had recognised its (unrealised) loss of 140 billion euros, this discussion would have been even more heated.

After first looking at the Fed’s large unrealised losses (link) and then at its realised losses (link), today I end my little odyssey on central bank finances with an analysis of euro area central banks. We start with a look at the ECB, then turn to the largest national central bank in the euro area, the Bundesbank, and finally discuss what it all means.

ECB’s results for 2022

Funnily enough, the European Central Bank’s (ECB) expenditure in 2022 was exactly – that is, literally exactly, to the last decimal place – equal to its income. Or, to be more precise, ECB reported a profit of exactly 0 euros for 2022.

To understand this, we need to talk a little about the fascinating features of central bank accounting.

Like the Fed, ECB bought enormous amounts of bonds after the 2008 global financial crisis and during the pandemic. At the end of 2022, ECB’s assets were worth €700 billion, of which the largest part (€457 billion) was its bond portfolio. The bonds were bought when interest rates were very low. Since summer 2022, ECB has raised the monetary policy interest rate from -0.5% to 3.5%. As a result, market yields have risen, and the value of the ECB’s bond holdings has fallen.

The ECB shows these assets in its balance sheet at amortised cost. In the notes to the balance sheet, ECB states that the market value of the securities is €398 billion. This means that ECB has unrealised losses of €457 billion – €398 billion = €59 billion on its securities purchased under the various asset purchase programmes.

ECB’s capital is €8.8 billion. If ECB reported its securities at market value, ECB would be insolvent; the loss of €59 billion would more than deplete its capital. However, as ECB does not recognize these losses, it carries on as if everything is fine.

Thus, let us instead turn to ECB’s realized losses and gains.

ECB had positive net interest income of €900 million in 2022 and fees (mainly supervisory fees collected by ECB from the banks it supervises) of €600 million. The ECB also has “own funds”. These comprise “the ECB’s financial resources, namely paid-up capital and amounts set aside in the general reserve fund and in the provision for financial risks.” Fluctuations in the market value of own funds are reported in the income statement. ECB lost €1,840 million here in 2022, because the bonds held in its own funds lost value as interests rose in 2022.

So ECB’s accounts work like this: At the end of 2022, ECB has €59 billion in losses in its monetary policy bond portfolio. However, these losses are not shown in the income statement of ECB because these bonds are reported at Hold-to-Maturity values. The losses from the ECB’s own funds of EUR 1,840 million, on the other hand, are shown in income statement. Confusing? Yes, but that is the way it is. Clear reasons for these different accounting treatments of losses in ECB’s different bond portfolios? No.

How come ECB ends up showing a profit of zero? The income of ECB (net interest income, fees, etc.) is not enough to cover the costs (write-down of own funds, staff costs etc.). ECB, however, apparently does not want to show a loss. That is why ECB releases part of its provisions for financial risks. 1,627 million euros are being released. This covers exactly the net losses. The financial result is then zero euros. More details can be found here (link).

Provisions are buffers built up over time. When ECB has made profits in the past, part of them has been saved as a buffer, which ECB now draws on.

These buffers amounted to €6,566 million at the end of 2022. What happens if the ECB continues to make losses and its buffers are eventually used up? Then the national central banks of the euro area could make up for the losses. Or, as ECB writes (link), “the loss could be booked to the ECB’s annual account and offset against future income”, i.e. the ECB could issue IOYs. This is similar to the IOYs (Deferred assets) that the Fed is now issuing to the US Treasury, as I described in my previous post (link)

ECB vs. the Eurosystem

Most of the assets purchased under the various Eurosystem asset purchase programmes were purchased by the national central banks, i.e. the Deutsche Bundesbank, the Banque de France, the Banco de Italia, and so on. To examine these, we need to move from the balance sheet of the ECB itself to the consolidated balance sheet of the Eurosystem. The consolidated balance sheet includes the balance sheets of the national central banks of the Eurosystem and the ECB.

Figure 1 shows the expansion of the Eurosystem’s consolidated balance sheet. The figure shows that securities purchases, i.e. Quantitative Easing, account for the main part of the balance sheet expansion. In 1999, euro area central banks held almost no securities on their balance sheets; securities accounted for 3% of assets. In 2022, euro area central banks held securities worth more than €5,000 billion, and securities represented more than 60% of total assets.

Data source: Webpage of the ECB.

The securities are reported at amortised cost (Hold-to-Maturity value). While ECB, as mentioned above, reports the market value of its monetary policy securities holdings in the notes to the balance sheet, the market value of all securities held in the Eurosystem is not reported. This is regrettable. It would have been transparent to report these market values, as most asset purchases were made by the national central banks (NCBs) of the euro area. Therefore, the NCBs will also bear the bulk of the losses. Since ECB does not report the market value of the securities held by the NCBs, it becomes somewhat cumbersome to determine the total losses in the Eurosystem, as one has to examine the balance sheets of all national central banks. We do not want to do that here. Instead, I will focus on the largest NCB, the German central bank, the Bundesbank.

Bundesbank’s losses

The Bundesbank’s balance sheet total at the end of 2022 was €2,904 billion.

€1,267 billion of this represent “Other claims within the Eurosystem (net)”, which is the Bundesbank’s net claim on ECB arising from cross-border payments within the Eurosystem’s TARGET2 payment system. TARGET2 balances are important and interesting (link), but for another day. Today we are looking at the Bundesbank’s holdings of euro-denominated securities, which amounted to €1,073 billion at the end of 2022. This means that the Bundesbank holds more than one fifth (€1,073 billion out of €5,102 billion) of all securities held by the Eurosystem.

Perhaps you have forgotten all the abbreviations used to refer to the many asset purchase programmes launched by the ECB. At least I admit that I have forgotten some of them. The Bundesbank provides a fascinating table showing the holdings of each programme (SMP, CBPP, CBPP2, APP, PSPP, CSPP,……), reproduced here as Table 1.

Data source: Table from the 2022 Annual Report of the Bundesbank.

In addition to this fascinating overview of the many different programmes, Table 1 contains another important piece of information: the value of unrealised losses from the Bundesbank’s bond portfolio. Table 1 shows that the balance sheet value (value at amortised cost) of the bonds is the €1,073 billion already mentioned. The market value, however, is €934 billion. The Bundesbank has thus made an unrealised loss of €139 billion! This is more than twice as much as ECB lost. It is a loss of 13% of the amortised-cost value of the securities.

It is also interesting to compare the figures for 2021 and 2022. The market value has fallen by €94 billion from 2021 to 2022, although the Bundesbank has bought more bonds in 2022, as shown by the €45 billion increase in the balance sheet value.

Central banks do not pay much attention to these unrealised losses, we now understand, even if they run into the hundreds of billions. Private commercial banks cannot afford to think like that – remember Silicon Valley Bank (link)?

On the other hand, central banks care about realised losses. As described above, ECB released 1,627 million euros from its reserves, so that the financial result for 2022 was zero euros. The Bundesbank is doing something similar. As Bundesbank President Joachim Nagel explained at the presentation of the Bundesbank’s annual report for 2022 (link): “The Bundesbank is reporting a result of zero in its profit and loss account for the 2022 financial year. We are tapping €1 billion of our provisions for general risks.”

This is how it works: The Bundesbank had a net interest income of €4 billion, but it lost (wrote down) the value of its securities by €922 million. To cover these losses, it took a little more – €972 million – from its reserves. Considering other major expenses such as TARGET2 expenses and personnel costs, the Bundesbank recorded a loss of €172 million. It then withdrew €172 million from its reserves. The final financial result for 2022 is exactly zero euros. More details can be found here (link, page 36).

There are two small details here that may be worth noting. First, ECB reports a “true” result of zero euros. Bundesbank reports a “loss of the year” of €172 million that they then cover by relying on their reserves. You can thus debate whether Bundesbank in fact makes a loss of €172 million or a result of zero. Bundesbank itself, as mentioned, calls it a result of zero. Second, you may wonder how Bundesbank’s unrealized loss of €139 billion relates to its €922 million write-down of its securities. The point is that euro-denominated assets are not written down, while losses on foreign-denominated assets due to exchange rate movements are. So, the write-down of €922 million is mainly due to foreign-denominated assets being worth less in euros because of exchange rate movements during the year. On the other hand, the loss of €139 billion in Bundesbank’s euro-denominated bond portfolio is not included in the profits/loss statement. It is only reported in the notes to the balance sheet. If Bundesbank were to write down its bond portfolio by its unrealized losses, the Bundesbank would be insolvent.

A rare or a usual event?

So, ECB and the Bundesbank both report financial results of zero euros. There seems to be a pattern here, and there is.

This interesting paper (link), forthcoming in the Journal of Finance, shows that central banks prefer to avoid negative results.

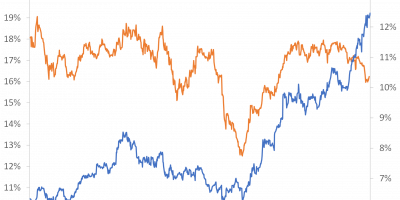

The authors have worked through the annual reports of more than 150 central banks over more than 20 years. The most important result of the paper comes from a figure that I reproduce here as Figure 2. The figure shows the distribution of central banks’ financial results (net income scaled by total assets).

Data source: Figure from link

There is a clear discontinuity at zero in Figure 2. There are about 60 observations where central banks report slightly negative results; the height of the column directly to the left of the dashed line at “0”. On the other hand, there are more than 350 observations where central banks report zero and slightly positive outcomes; the height of the column to the right of the dashed line at “0”. The paper runs numerous statistical tests to see if there is a discontinuity here. The result is robust. Central banks prefer zero or positive outcomes to negative outcomes.

Why do central banks dislike negative results?

Central banks make a point of emphasising that negative financial results are not a problem. For example, in his aforementioned introductory remarks at the presentation of the 2022 Annual Report, the Bundesbank President stated (link): “Unlike commercial banks, central banks do not seek profits, cannot be insolvent in the traditional sense, as they can in principle issue more money to meet their obligations in domestic currency, and do not have to meet minimum regulatory capital requirements precisely because of their unique purpose.” Basically, the Bundesbank president argues, it does not matter whether central banks make profits or losses.

But that is not what the actions of central banks show. Their actions show that they do not like negative outcomes, cf. figure 2.

The Journal of Finance paper examines why this is so. It finds that small positive outcomes are typically reported when inflation is high and monetary policy rates are low. This suggests two things. First, central banks’ profit incentives are not independent of their monetary policy decisions and outcomes. Second, central banks’ preference for positive outcomes suggests agency problems, meaning that central banks fear that politicians might interfere in their monetary policy decisions if they report losses. To avoid this, they juggle the numbers so that they end up with a result of zero or slightly above.

A case in point

The current Bundesbank discussion is an interesting case in point.

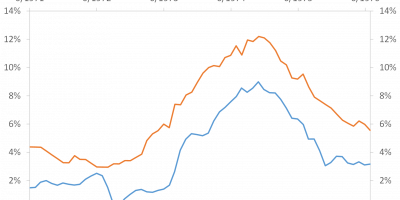

Bundesbank generally makes a profit, which it transfers to the federal government. Figure 3 shows the Bundesbank’s annual results and transfers to the German state since 1957.

Except for the 1970s, when the Bundesbank recorded high losses and consequently did not transfer any profits to the federal government, the Bundesbank has traditionally made profits which it transferred in full to the state. Thus, in the period 2010-2020, the Bundesbank made profits of €25 billion, which it transferred to the federal government, a nice contribution to Germany’s public finances.

Data source: Bundesbank.

Now the Bundesbank is no longer making profits, it is not returning anything to the federal government and is tapping into its provisions.

But that was 2022. The Bundesbank (and other central banks) is expecting substantial losses in the future because the ECB’s monetary policy interest rates will remain elevated for some time to fight super-high inflation.

The Bundesbank has 19 billion euros in provisions plus 2.5 billion euros in capital. This should be enough to cover the expected losses for 2023, but Bundesbank states transparently that: “In subsequent years, however, the burdens are expected to exceed our financial buffers, so that we will report a loss carryforward.” So in the future the Bundesbank will issue IOYs to the German government, just as the Fed does now with its “Deferred asset” (link). This all sounds good, but in reality, it probably is not.

The Financial Times recently reported in an interesting article that the German Federal Audit Office has warned that the Bundesbank may need a bailout from the German government (link)!

The article referred to a report by the German federal audit office which said: “If the functioning of the Bundesbank is endangered by an inadequate or even negative equity capital, the Federal Republic of Germany can be obliged to inject capital”.

This is crazy stuff. The official German federal audit office states that the German government may have to use taxpayers’ money to recapitalise the German central bank. Some politicians will argue that it would be better to spend the money on other things, such as schools, hospitals, etc. If the Bundesbank has to be rescued, there will be a public outcry and much criticism – justified or unjustified. This could jeopardise the Bundesbank’s independence – formal or informal.

According to the FT article, the German federal audit office declined to comment, so we do not know the status of the report, but apparently the Bundesbank felt the need to clarify that it does not believe a recapitalisation will be necessary. The Bundesbank stated that it can issue IOYs (“loss carry forwards”), link.

The irony is that the Bundesbank was very sceptical about the massive Quantitative Easing programmes of ECB. Former Bundesbank President Jens Weidmann repeatedly voted against the rest of the Governing Council of the ECB when yet another asset purchase programme was debated at the ECB (here is just one example; link). Now the Bundesbank is in the midst of discussions about whether it needs to be bailed out by the German government. And, remember, the Bundesbank (in tradition with other central banks), has not even accounted for its unrealised loss of €139 billion on its bond portfolio. Imagine the outcry if it was to do so.

These discussions are not good for the Bundesbank. It would have preferred to avoid them. By reporting a zero result, the Bundesbank takes some of the pressure off itself, at least for now.

Conclusion

Central banks are losing a lot of money these days. In public statements they claim that this is not a problem and does not affect their decisions, but their actions show that it is more complicated than that. Their actions indicate that they prefer to avoid losses. For 2022, for example, both the ECB and the Bundesbank report a financial result of exactly zero euros.

It is to be feared – and scientifically proven – that reluctance to realise losses could influence central bankers’ monetary policy decisions. When you are sitting on thousands of billions of euros worth of bonds and you know that you will lose hundreds of billions of euros if you raise monetary policy interest rates, you might think twice before doing so. You should not, but you might.

This also sheds new light on ECB’s decisions last year. You probably remember that ECB was very slow to raise interest rates last year, which frustrated me and many other observers. The most likely reason was that ECB feared what would happen to interest rates in Italy (link). Only when ECB had new policies in place did it raise interest rates (link).

Perhaps, however, there was an additional reason, that is that central bankers prefer to avoid losses. Did it have any influence on the ECB’s decision to keep interest rates too low for too long that it knew it would lose a lot of money if it raised rates? I hope not, but I cannot completely rule it out either.

Eventually interest rates were raised and central banks lost a lot of money.

These losses matter. Governments will receive less revenue from central banks and monetary policy decisions may be affected. Central bankers face many difficulties; some of them self–inflicted.

———————————–

PS

I thank Professor of Accounting Igor Goncharov (link), one of the authors of the Journal of Finance article, for helping me understand some of the mysteries of central bank accounting as I prepared this analysis.