Will the US and euro area economies contract during 2023? I present three views: Those of bond-market investors (as represented by yield spreads), the views of professional forecasters, and my own views. All agree that growth will be low during 2023, but there is disagreement whether we will have a recession. Bond markets are very negative, I am somewhat negative, and professional forecasters are the least pessimistic.

I am writing this during the last week of 2022. What a year. Who had imagined we would have war in Europe, very high inflation, high interest rates, contracting stock and housing markets, and so much more – and this all at once. Some argue it is difficult to remain an optimist. And then, Messi and Argentina won the world cup. Given I admire his genius, this did make me happy.

Now, 2023 is just around the corner. What should we expect? Will economies contract in response to the negative events during 2022? Or will we avoid the recession?

Pessimists argue that people’s consumption possibilities have been severely impacted by the multitude of shocks during 2022. These include not least high inflation that reduces people’s real income, high interest rates that raise people’s mortgage bills, and lower stock and house prices that reduce the value of people’s savings. When households cut consumption, firms will cut production and investments, and the economy will contract.

Optimists argue that while it is true that the economy will slow down during 2023, because of the many negative shocks, the underlying economy is resilient. Job markets are strong, in particular in the US, but also in Europe. People have accumulated savings during the pandemic, meaning they have the means to maintain consumption despite high inflation and mortgage rates. Finally, banks are better capitalized, thus being able to support households and firms during the storm.

The difficulty is that there is some truth to both views. Real incomes have fallen because of high inflation, but the labor market is strong. So, what should we expect? I will provide three views: The views of financial market investors, as represented by yield spreads, the views of professional forecasters, and my own view.

Yield spreads

Yields on short-dated bonds are highly correlated with monetary policy rates. Hence, short-term yields are rising because monetary policy is being tightened.

Yields on long-dated bonds are determined by investors. Long-term yields have been rising during most of 2022, though have fallen during the past couple of months.

The interaction between long and short yields reveals investors’ expectations to future inflation and economic activity.

If investors expect monetary policy rates have not been hiked sufficiently to contain inflation, i.e. that economic activity and inflation will remain high, investors will require higher long-term yields if they should buy long-term bonds. In this case, where investors do not expect a recession, because the central bank has not hiked monetary policy rates enough to contain inflation, yields on long-dated bonds will be high relative to yields on short-dated bonds. We say that the yield curve is upward sloping (long yields higher than short yields).

If, on the other hand, investors believe the central bank has raised short-term yields so much that economic activity will contract and inflationary pressures abate, long-term yields will be relatively low. We say that the yield curve is downwards sloping (long yields lower than short yields).

In turns out that the difference between yields on short- and long-dated bonds (called “the slope of the yield curve”) has been a consistent predictor of recessions, in particular in the US. Chapter 15 in my book describes this in further detail (link).

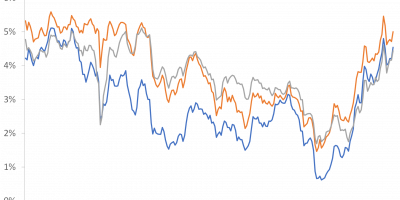

Figure 1 shows the difference between yields on 10- and 2-year US Treasuries (10y-2y) and the difference between yields on 10-year and 3-month US Treasuries (10y-3m). Some people prefer the 10y-3m spread, while others prefer the 10y-2y spread. Personally, I prefer the 10y-3m spread, but as Figure 1 reveals, the two spreads often tell the same story.

Data source: Fed St. Louis Database.

Right after leaving a recession (recession are highlighted by shaded areas in Figure 1), that is during early phases of expansions, central banks keep short-term rates low, thereby promoting economic activity and fueling inflationary pressures. Investors want compensation if they should buy long-dated bonds, and long yields are higher than short yields. The yield curve is upward sloping. During late phases of expansions, that is, shortly before recessions, central banks hike short-term rates to reduce inflationary pressures, sending short-term yields higher than long-term yields. The yield curve becomes “inverted”.

The stunning thing is that this – yield-curve inversion – has preceded almost all US recessions. The slope of the yield curve is a strong predictor of recessions.

Currently, as Figure 1 reveals, the yield spread is negative. Short-term yields are more than 50 basis points percentage point higher than long-term yields. This has not happened often. The last time it happened was before the severe recession in the early 1980s. The bond market sends a negative message: Bond-market investors expect the US is facing a recession.

In spring, I wrote an analysis of the yield spread as a predictor of recessions (link). I noticed something interesting. Normally, the two spreads (10y-2y and 10y-3m) send the same signal, as mentioned and as seen in Figure 1. However, this was not the case during spring 2022. Figure 2 is an updated version of the figure I showed back then, with an indication of the development since I wrote that analysis.

Data source: Fed St. Louis Database.

Figure 2 reveals that – since their divergence in early 2022 – the two yield spreads have converged and now send the same message: The US economy is facing a recession.

The New York Fed translates the yield spread into recession probabilities (link). The Fed expects there is a 38% probability that the US economy will be in recession 12 months ahead. This recession probability is as high as right before the global financial crisis of 2008.

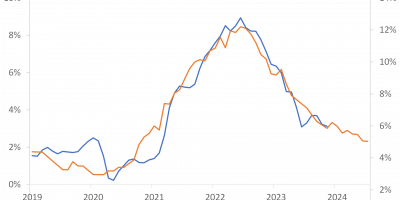

For the euro area, I pick the German yield spread to illustrate (Figure 3). During spring, when I wrote my previous analysis, long yields were considerably higher than short yields. Today, the yield curve is flat, potentially indicating an upcoming recession. As I mention in my book, the yield spread has been a better forecaster of recessions in the US than elsewhere, though.

Data source: Datastream via Refinitiv.

Professional forecasters

The bond market reflects the expectations of bond-market investors. This is relevant because (i) they put their money where their month is and (ii) the yield curve has historically been a reliable predictor of recessions, as mentioned. But, still, bond-market investors are not explicit economic forecasters. So, what about asking those people who make economic forecasts for a living?

There are many forecasters out there. Any large bank will have a team that publishes such economic forecasts. Central banks collect the views of all these people. It is called a Survey of Professional Forecasters.

Figure 4 shows the results from the latest survey (Q4 2022 Survey of Professional Forecasters) of real economic growth in the US. To its left, the figure shows expected economic growth during the current quarter and the subsequent four quarters. The right-hand columns show forecasts for 2024 and 2025.

Data source: Federal reserve Bank of Philadelphia (link).

The main message in Figure 4 is that professional forecasters do not expect the US economy to contract. Growth is expected to be low – barely above 0% – during the first two quarters of 2023 but is expected to remain positive. No recession here.

At the end of 2023, forecasters expect economic growth will have normalized and stabilized at an annualized rate of close to 2%, which will continue during 2024 and 2025.

For the euro area, the story is a little different. Forecasters are slightly more pessimistic, as Figure 5 shows.

For the euro area, professional forecasters expect growth to be negative during the current (Q4 2022) and the first quarter of 2023. After this, growth turns positive, forecasters expect. In 2024, growth has been normalized at 1.6%.

Data source: ECB (link).

My own expectation

Long before ECB started raising rates, I argued they should do so because I feared inflation would be difficult to combat. This turned out to be true. Inflation is 10% in the euro area and 7% in the US. Even when inflation has started to fall, it is still much too high. And more worrying, core inflation has shown only few signs of abating. I still fear it will take time to bring inflation back to target (2%). My best guess is that inflation will remain above target during 2023 and 2024. For this reason, monetary policy rates must remain high for some time.

High inflation and high interest rates will hurt economic activity. While I recognize the labor market is strong, I lean more towards the pessimistic than the optimistic camp.

I thus think it will be difficult to avoid the recession, both in Europe and in the US.

I am not a super pessimist. I do not think it will be a severe recession, of course barring unforeseen major events such as an escalation of geopolitical tensions (Ukraine, Taiwan) or the like.

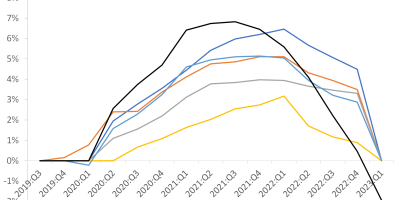

While I am not in the business of making explicit numbers-based macroeconomic forecasts, I can try to illustrate what I mean by comparing the past two recessions, using US data. Figure 6 shows real US GDP in trillions of USD.

Data source: Fed St. Louis Database.

Following the global financial crisis of 2008, it took three years before economic activity reached its pre-crisis level. This was a severe recession. Following the deep, but short-lived, 2020 recession, it took 1.5 years. The recession I see in front of us is something in between. Not as deep as the 2020 pandemic-induced recession, but not as long-lasting as the 2008 recession either.

Conclusion

Everybody agrees economic activity will slow down during 2023. The question is how much. Will economies contract or will we avoid a recession?

Yield spreads indicate a severe recession.

Professional forecasters expect either a mild or no recession. I am somewhere in between. There are worrying signs, not least high inflation and high interest rates, but there are also comforting factors, such as strong underlying demand. Weighting the pros and cons, I would be surprised if we avoid a recession during 2023. I would also be surprised if it turns out to be a severe recession.