The Fed has spent trillions of dollars buying government and mortgage bonds as part of its Quantitative Easing programmes to prop up the economy. In 2022, yields have risen as the Fed has tightened monetary policy to combat sky-high inflation. When yields rise, bonds lose value. The Fed now has unrealised losses on its bond holdings of more than $1 trillion, far exceeding its capital. The Fed would be in trouble if it were a normal bank. But it is not, so what are the consequences? This is the first part of a small two-part analysis. In this part I describe Fed’s unrealised losses. In the second part, I will describe Fed’s realised losses.

In recent months, Silicon Valley Bank, First Republic, and other large US banks have gone bankrupt or been taken over in forced mergers. The banks suffered large losses on their bond holdings as interest rates rose during 2022. Higher interest rates mean falling bond prices. This may not be a problem if you can hold your bond to maturity, because you there get the face value of the bond, but if you have to sell your bond before maturity – perhaps because depositors pull out their money – you realise the losses. Academic research, which I cite in my recent blog post (link), estimates that the US banking system has $2 trillion in such unrecognised losses, equivalent to the total equity of US banks.

In this post I describe some unrealised losses that are less noticed but equally interesting: The Fed has accumulated unrealised losses that far exceed its capital. If the losses are realized or marked-to-market, the Fed is bankrupt.

Why is there no outcry? Will the Fed really be bankrupt if the losses are realised? In this analysis I answer these and similar questions. I mainly talk about the Fed, as the situation there is the most extreme, but many other central banks face similar situations, which makes understanding the issue even more important.

Unrealised losses and the Fed’s (in)solvency

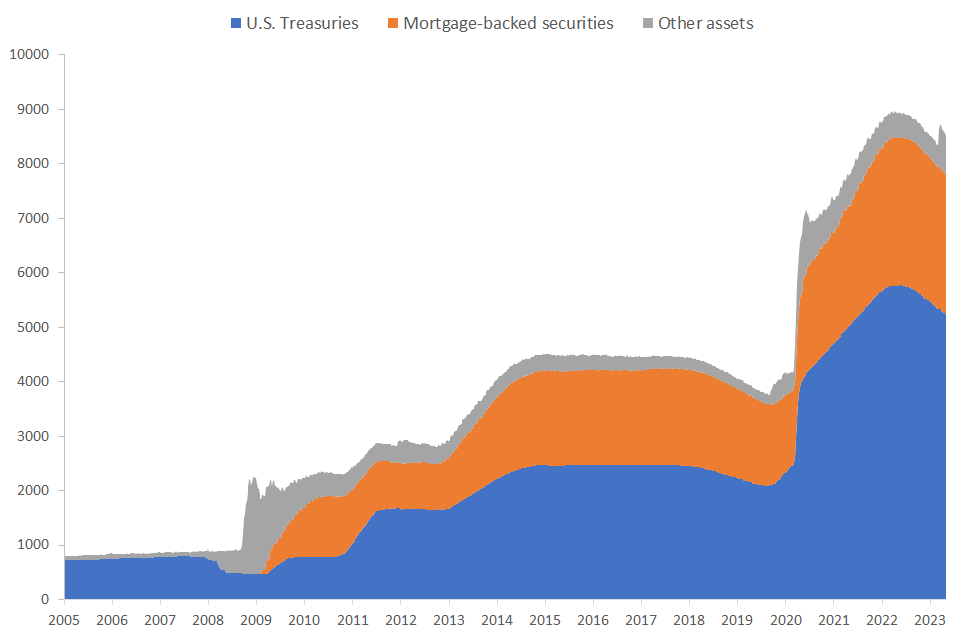

As part of its Quantitative Easing (QE) programmes to support the US economy, the Fed has purchased bonds worth trillions of dollars. Figure 1 shows the development of the Fed’s holdings of government bonds (US Treasuries), mortgage bonds and other assets.

The Fed now (May 2023) owns nearly $8 trillion worth of bonds. That is a sevenfold increase since the 2008 financial crisis.

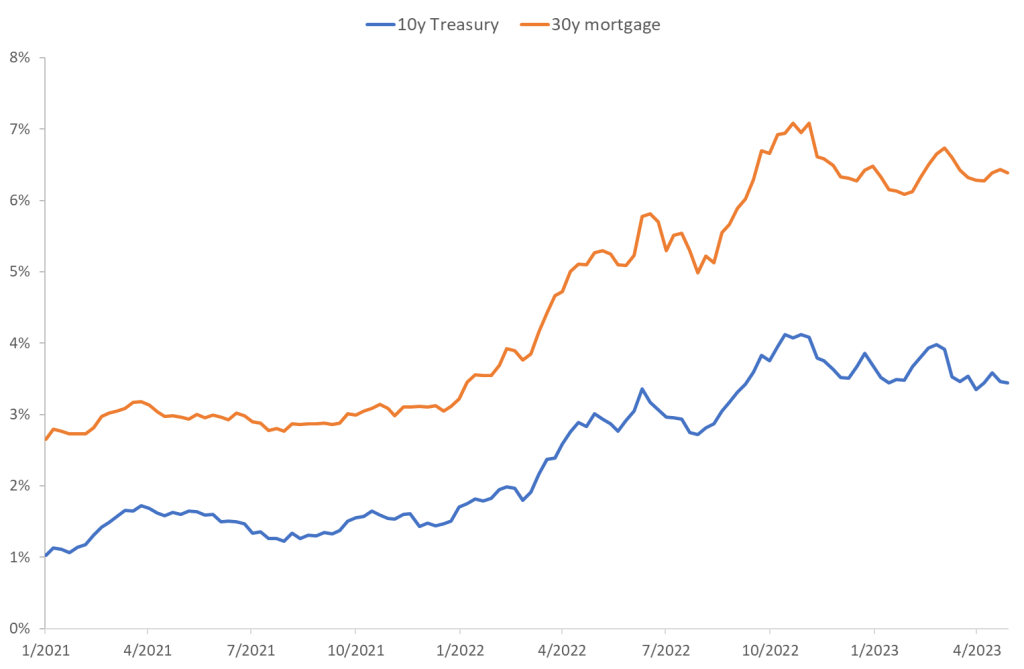

The Fed has been aggressively raising interest rates in 2022, in response to the inflation flare-up. This affects the bond market. Yields on government and mortgage bonds have risen. Figure 2 shows how the yield on 10-year government bonds has risen from 1% in 2021 to 3.5% today, while the yield on 30-year mortgage bonds has risen from 3% to more than 6%.

When yields rise, bond prices fall. When the Fed owns nearly $8 trillion worth of bonds, the losses are enormous.

The Fed reports its bonds at amortised cost. Amortised cost does not reflect the losses in value due to rising interest rates. As with the private banks that have recently gone bankrupt (Silicon Valley Bank, First Republic, etc.), it is fair to say that the Fed balance sheet paints a rosy picture of the true situation.

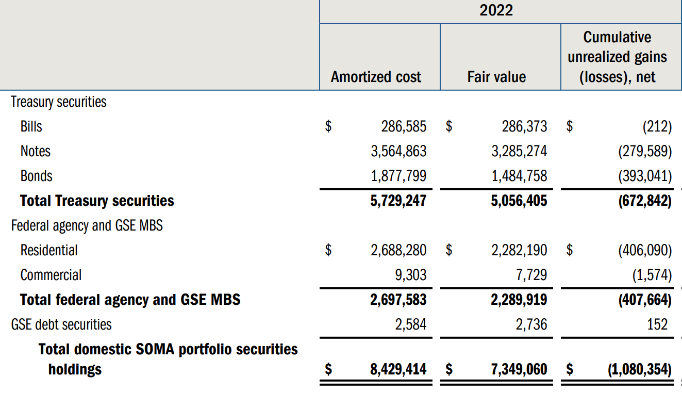

The Fed publishes the fair value (market value) of its bond portfolio in the notes to the balance sheet (link). The difference between the fair value and the value at amortised cost is the unrealised loss. It is reprinted here in Table 1.

At the end of 2022, the value of government bonds held by the Fed was USD 5,729 billion when reported at amortised cost, while the value of mortgage bonds (Federal Agency and GSE MBS, which are mortgage-backed securities (MBS) issued by Government Sponsored Enterprises (GSE)) was USD 2,698 billion. This gives a total value of the SOMA (System Open Market Account) portfolio of $8,429 billion at the end of 2022. SOMA is the portfolio of assets purchased by the Fed under its QE programmes.

The fair value of the portfolio is significantly lower than the book value. The fair value of the SOMA portfolio is $7,349 billion, Table 1 shows. The difference between the value of the portfolio at amortised cost and fair value is the unrealised losses on the portfolio. The unrealised losses in the Fed’s bond portfolio amount to more than USD 1 trillion, namely USD 1,080 billion!

(The Fed has a nice description of all these accounting details here: link).

The problems in Silicon Valley Bank and First Republic really began when they had to sell their bonds (to raise cash to pay depositors who withdrew their money). At that point, the banks had to realise those losses that had not been realised by then. If the Fed had to sell its bonds, it would similarly realise otherwise unrealised losses. Assuming no impact on bond prices – which is a very strong assumption – the Fed would realise losses of $1,080 billion if it had to liquidate its bond portfolio.

Unrealised losses and interest rate changes

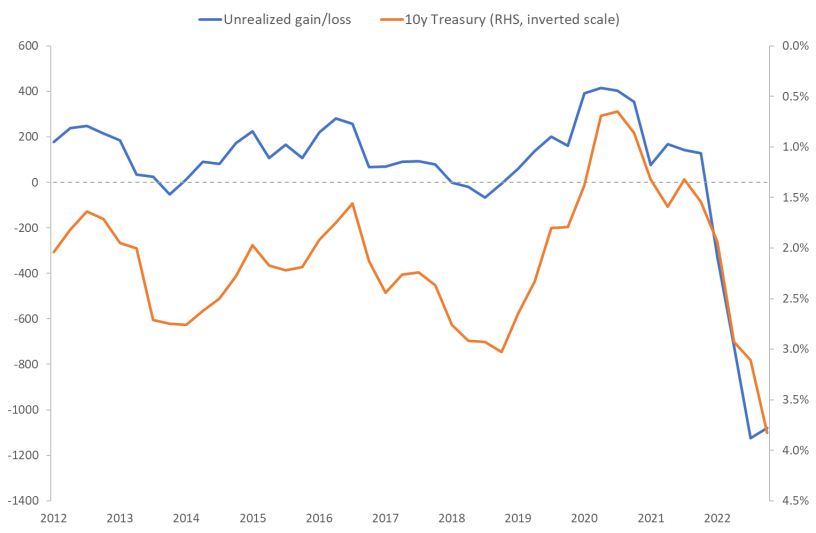

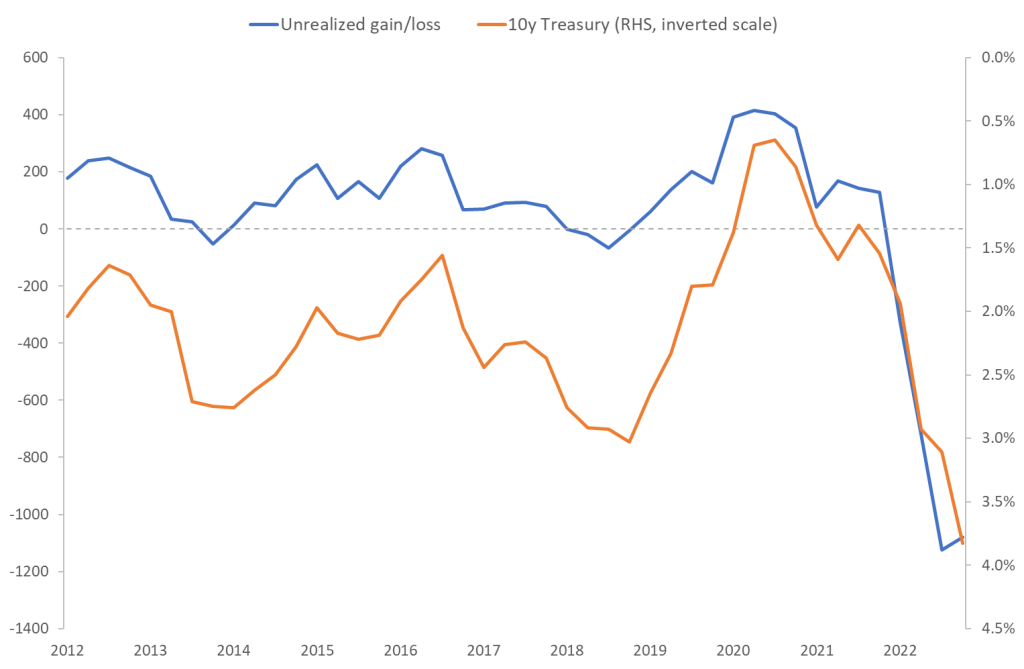

The Fed accumulates losses on its SOMA bond holdings because it raises the monetary policy rate and market rates follow. This can be seen in Figure 3.

Figure 3 shows how unrealised gains and losses follow the general trend in yields, here represented by the yield on the 10-year Treasury (note that the 10-year yield in Figure 3 is on the right-hand axis and is inverted).

When interest rates fell in 2014-2015 and 2019-2020, the Fed saw gains on its SOMA portfolio. In 2022, when interest rates rose, the Fed recorded very large losses.

Losses and capitalization

The irony is that the unrealized losses far exceed the Fed’s equity. At the end of 2022, the Fed’s total capital was $42 billion. Since the unrealised losses on the Fed’s bond portfolio far exceed its capital, the Fed would be bankrupt under accounting rules that reflect fair value.

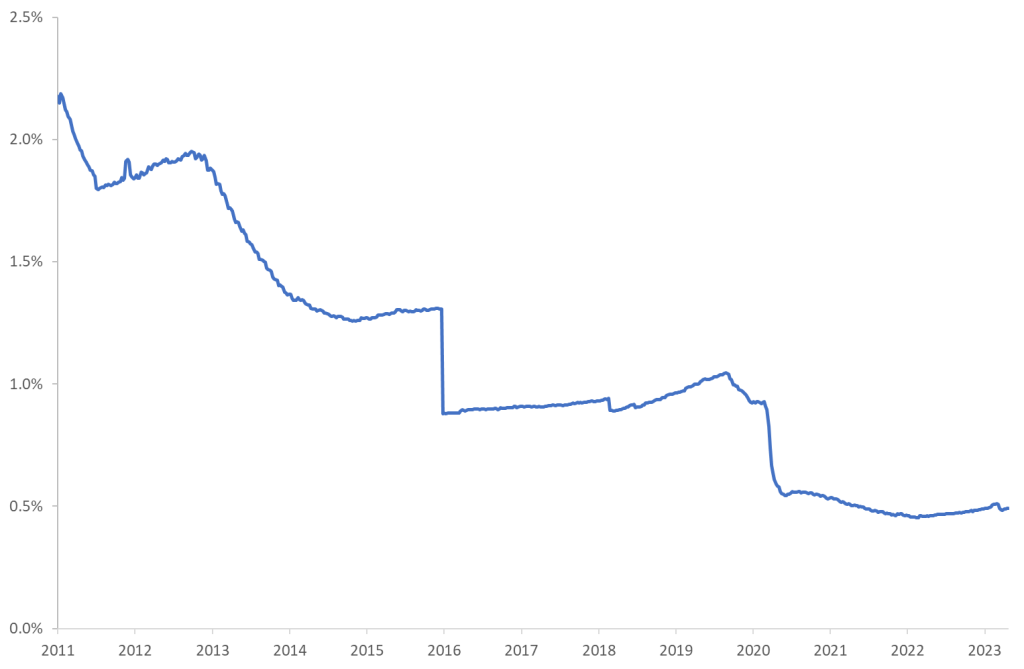

The Fed is a thinly capitalised bank. The Fed’s total assets amount to more than eight trillion USD. Total capital amounts to USD 42 billion. This represents a capitalisation of 0.5%. As Figure 4 shows, a decade ago capitalisation was around 2%. Fed’s capitalisation has fallen during a period when it has taken on a lot of interest rate risk.

Since the financial crisis, there has been much discussion about the right amount of capital for banks. For example, the largest private bank in the US, J.P. Morgan, has total assets of $3,700 billion and equity of $292 billion. That is a capitalisation of 8%. Whether that is too much, too little or just right is a topic for another day. What I am getting at is that this small comparison shows how little capital the Fed holds.

The Fed does not pursue an active capital policy, like ordinary commercial banks do. Instead, the Federal Reserve Act requires the Fed to remit any excess earnings to the US Treasury, after the Fed has provided for operational costs and so on. This means that capitalisation “automatically” declines when the balance sheet expands, e.g. due to QE. The low capitalisation thus reflects the role and law that guides the Fed.

Could the Fed default on its obligations?

One can argue that the Fed does not need much capital because it has no ordinary depositors. The Fed will not face a run on its liabilities that would force it to sell assets and realise otherwise unrealised losses, as was the case with Silicon Valley Bank, First Republic and similar institutions. In other words, it is unlikely that the Fed will have to realise the unrealised losses.

But what if it did somehow realise the losses? Can a situation arise where the Fed has no money to cover its expenses, for example the salaries of its employees? No. The Fed can always increase reserves to pay its bills, and banks must hold reserves created by the Fed.

There is literature on whether central banks need equity and can go bankrupt, see link, link, and link. BIS also has a detailed exposition of central bank finances, in case you are interested (link). This literature emphasises that central banks cannot go bankrupt in the conventional way. It follows that the fact that the Fed loses money does not limit its ability to raise or lower the monetary policy interest rate.

This is not to say that one cannot imagine extreme scenarios in which the Fed becomes restrained in its monetary policy. For example, losses could become so large that the Fed has to build up very large reserves, possibly to the point where the money supply grows so fast that it creates inflation. In such an extreme situation, it could become more difficult for the Fed to achieve its goal of low inflation. Alternatively, in such a scenario, the central bank might have to be recapitalised by the Treasury in order to fulfil its task, with corresponding political costs. Even if central banks are always able to pay their bills because they can create reserves, strange and unfortunate situations can arise if central banks lose a lot of money. At the moment, however, these scenarios seem unlikely.

Other central banks

I have referred to the Fed’s situation because it is the most extreme, but many central banks are in a similar, albeit less extreme, situation. Many central banks have bought bonds in QE programmes since the 2008 global financial crisis, and many central banks have raised interest rates in 2022 to combat very high inflation. As a result, many central banks have accumulated large unrealised losses in their bond portfolios.

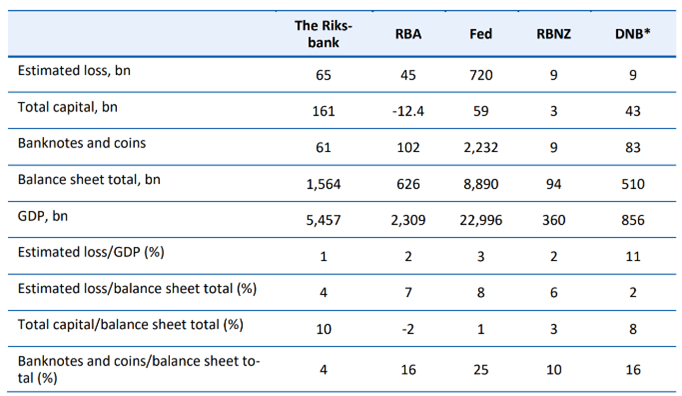

The Swedish Central Bank has compiled information from various central banks (link). It turns out that it is not as simple as it may sound to compare these unrealized losses because central banks use different accounting rules, report losses in different ways and so on. The Swedish central bank has done its best and reports the figures I have copied into Table 2 below (the article is from September 2022, which is why the Fed’s losses are different than the ones I use above).

Table 2 shows that central banks have lost between 1% (Riksbank) and 11% (DNB) of GDP on their bond holdings accumulated under various QE programmes. These are undoubtedly considerable losses. Table 2 also shows the losses in relation to total capital of the central banks. The Fed, as mentioned, is the most extreme. In the autumn, when the Riksbanken published its analysis, the Fed’s losses amounted to USD 720 billion, more than ten times its capital. DNB lost twice its capital and the Riksbanken 30%. The Fed is not alone.

Conclusion

When a company’s liabilities exceed its assets, the company is bankrupt. If the Fed reported its assets at market value, the losses would far exceed its capital. The Fed would be bankrupt.

Central banks, however, are special. First, it is unlikely that situations will arise in which the Fed will have to realise otherwise unrealised losses on its bond portfolio. This is different from private banks, which may be forced to realise such losses if, for example, depositors withdraw their money. Second, central banks can create bank reserves. For this reason, the case where a central bank cannot pay its bills will not occur. In this analysis, I have discussed Fed’s unrealised losses. In my next analysis (link), I will discuss Fed’s realised losses. You will see that the Fed has realised losses that exceed its capital. I will describe how the Fed deals with this, what the consequences are and who pays for it.