Normally, the Fed makes a profit, which it remits to the Treasury. These days, the Fed’s expenses exceed its income. For an ordinary company making a loss, equity would decline. However, the Fed’s losses do not affect its equity. Instead, the Fed uses a neat little trick: It creates a new asset that absorbs the losses. Consequently, despite its losses, the Fed will never go bankrupt. But the losses still matter. If the Fed makes a loss, it cannot pass profits on to the Treasury, which then has to find the money elsewhere. Whether this really has negative consequences is debatable. In my opinion, it does.

In my earlier analysis (link)I explained the Fed’s unrealised losses in its bond portfolio. These losses are very large – more than $1,000 billion – and far exceed the Fed’s capital. If the Fed were a normal bank with normal depositors, it would probably fail. But the Fed is not a normal bank. It will not realise these losses.

However, the Fed has accumulated other realised losses. These realised losses now also exceed Fed’s capital. When normal companies realise losses that exceed their capital, they go bankrupt. Why is the Fed not bankrupt?

Realised losses and the “neat little trick”

Like any ordinary financial corporation, the Fed generates income from its assets. It uses this income to pay those who provided the funds to finance the purchase of assets and to cover its operating costs.

Fed’s assets comprise mainly bond holdings, i.e., Treasury and Mortgage-Backed securities. Liabilities include private banks’ reserves held at the Fed and money parked at the Fed by money market funds in Reverse Repo Agreements. Bank reserves and funds provided by money market funds earn interest, i.e., they are costly to the Fed. Liabilities also include currency in circulation (notes and coins), which does not earn interest, i.e., is not costly to the Fed. Table 1 provides a simplified version of the 2021 Fed balance sheet.

Normally, the Fed earns more on its assets than it pays to its creditors, i.e., as a rule, the Fed makes a profit.

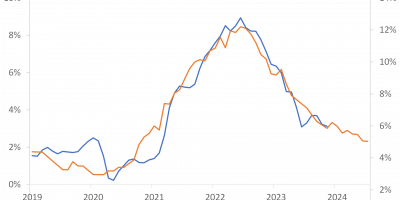

Prior to 2022, the Fed Funds Rate was very low, and the yield curve was upward sloping: Yields on long-dated assets exceeded yields on short-dated assets. The long-term yield the Fed earned on its bond holdings was consequently above the short-term yield the Fed paid its creditors. After deducting running costs (staff salaries, etc.), the Fed remitted its profits to the US Treasury.

Today the Fed Funds Rate is 5%. This means that the cost of issuing reserves and reverse repos has increased substantially. However, the yield the Fed receives on its bond holdings has hardly changed. This means that the Fed is now making a loss.

If the average yield on the Fed’s SOMA bond portfolio is 2% (probably not a completely crazy guess), the Fed was receiving a net interest of 2% on its bond holdings when the Fed Funds Rate was zero per cent. Today, by contrast, the Fed pays a negative net interest rate of minus three per cent, as the Fed still earns two percent on its assets but pays five percent on its liabilities.

A normal company would deplete its equity when it incurs losses. When the accumulated losses exceed the company’s equity (assuming the company does not raise new equity), the company is bankrupt.

That’s not how it works at the Fed. A loss at the Fed does not reduce the Fed’s equity. And why? Because the Fed is special. The Fed relies on what you might call a “neat little trick”. The Fed simply creates a new item on the asset side of its balance sheet called “Deferred assets – transfer to Treasury”.

Here’s how it works. When the Fed makes losses, as it does today, the value of the deferred assets increases by the amount of the losses. If the Fed later makes a profit, the value of the deferred assets is first reduced. When enough profits have been accumulated so that the Deferred asset is zero, the Fed can start transferring profits to the Treasury again.

As the Fed explains, “The deferred asset is the amount of net profits that the Federal Reserve Banks must realise before remittances to the U.S. Treasury resume.” In essence, the Deferred asset is an IOY. It is an asset, as this Fed paper explains (link), in the sense that “it reflects a reduction in future liabilities to the U.S. Treasury.”

I am sure that many ordinary businesses would love to be able to use such tricks. If your company make a loss, you simply create an IOY that your creditors have to accept so that your equity is not diminished. You carry on as if nothing had happened, despite the losses.

This, of course, is not the way it works for ordinary businesses, and fortunately so. When ordinary companies lose so much that their equity is gone, creditors line up and declare the company bankrupt. That’s how capitalism works. But the Fed is different.

Another peculiarity of the Fed, as I explained in my former analysis (link), is that the Fed can always create reserves to pay its bills. Therefore, even if the Fed earns less on its assets than it pays on its liabilities, there will never be a situation where the Fed cannot pay its bills.

You can follow the weekly movements of the Deferred asset here. You have to look closely, but in Table 6 (link) you can see that at the time of writing (June 2023), “Income transfers to the US Treasury” have a negative value of USD 65 billion. In other words, the Fed owes the Treasury $65 billion. This is more than its capital. In principle, the Fed is bankrupt. But it is not, because its capital is not reduced. The “Deferred asset” covers the losses.

Someone must pay for those losses, though. That “someone” is the US Treasury and therefore – ultimately – the US taxpayer.

How much money is at stake?

As mentioned, the Fed has already lost $65 billion, but with the Fed Funds Rate expected to remain elevated for some time as the Fed struggles with sky-high inflation, there will be further losses. The Congressional Budget Office (here) makes projections. Based on the expected development of inflation and thus the Fed Funds Rate, the CBO expects that the Fed will make losses in 2023 and 2024 and then return to profit in 2025. Deferred assets are expected to peak at $125 billion in 2024.

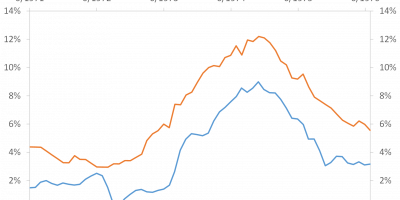

The Fed can only start transferring profits to the Treasury when it has reduced the Deferred asset to zero, i.e., when it has accumulated so much profits that it has “paid back” the Deferred asset, so to speak. The CBO expects that the Fed will be able to begin transferring profits to the Treasury in 2028. Figure 1 shows the expected development of the Deferred asset.

Data source: Congressional Budget Office (here).

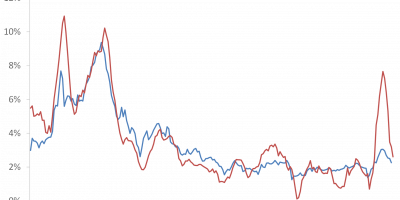

On average over the 2013-2021 period, the Fed has transferred $85 billion per year to the Treasury, plus a few transfers of capital surpluses (link). These are not peanuts. As Figure 2 shows, it is about 2% of total federal revenues on average. Figure 2 also shows that remittances have been relatively high since the Fed launched its QE programmes after the 2008 financial crisis. Remittances averaged 1.5% of total federal revenues per year over the period 1987-2008 and 2.7% per year on average over the period 2009-2021.

Source: CBO (link)

So, Fed’s losses do not cause the Fed to go bankrupt (since the Fed’s equity is not being written down), but they do have real consequences because the Treasury is missing out on revenue it normally receives.

Somebody has to pay

When its income falls, the Treasury must cut spending, raise taxes, increase debt, or some combination of the three. So, was it worth it that the Fed bought all those bonds that now generate losses causing lower income to the treasury?

Answer: It depends.

One argument is that while it is true that the Fed is making losses now and will continue to do so in the coming years, the Fed has made a lot of money in recent years on its SOMA portfolio holdings. This is related to Figure 2 which showed that the Fed made unusually large transfers to the Treasury between 2010 and 2021. The reason was that the Fed was buying a lot of bonds during QE, which were yielding interest, and the Fed Funds Rate was very low, which meant that banks and money market funds received little when they parked money at the Fed. Now, and for the foreseeable future, the situation has reversed, and the Fed is making losses.

This is a cost-benefit calculation: are current and future losses greater than past gains? Nelson and Levin (link) present a calculation. They estimate that the Fed has earned an extra $390 billion on the securities it bought up to 2020. Over the next ten years, they expect the Fed to lose about $220 billion. This translates into a net gain of $110 billion from the assets purchased before 2020. Nelson and Levin also calculate that assets purchased since 2020, i.e., during the pandemic, will reduce the Fed’s profits by $760 billion over the next ten years. In total, this means a net loss of $650 billion over the period 2010-2032. This is undoubtedly a considerable amount of money.

This brings us to the second argument. The Fed has all these losses because it bought all these bonds during its various QE programmes. There is, of course, a reason why the Fed bought all these bonds in the first place. It did so to support the economy. This positive effect on the economy must be taken into account when assessing the consequences of the Fed’s current losses, argue former Fed Board of Governors Vice Chairman Donald Kohn and Bill English (link). By supporting the economy, the Fed has lowered unemployment, allowing for higher tax payments to the Treasury (because workers pay taxes) and lowered spending on unemployment benefits, etc. So today the Treasury may not receive the $100 billion a year it has received over the past decade, but if the Fed had not bought all the bonds in the first place, the cost to the Treasury would be even higher because the economy would have suffered, Kohn and English argue.

This argument assumes that QE has had the desired effects on employment and economic activity. There is a debate about this. Some argue that QE was effective (link), while others argue that it was not (link), and some argue that the answer depends on whether you ask central bankers or academic economists (link).

This brings us to the final point: what if the Fed had not bought all the bonds? Then it would not have had the unrealised losses I described in my previous analysis (link) and the realised losses I describe here, and the Treasury would receive its usual remittances. Taxpayers would be better off, the argument goes.

Unfortunately, it is not that simple. You have to ask yourself who would have bought all those bonds if the Fed had not. The private sector would have. And if the private sector had held the bonds that the Fed now holds, the private sector would have borne the losses, not the Fed.

So, the important question here is probably not that the Fed suffers a loss, but whether distributional effects play a role. When the Fed makes a loss on its bond holdings, it transfers less to the Treasury and the Treasury needs to find the money elsewhere. If the Fed had not bought the bonds, the private sector and investors would have borne the losses.

Which is better? One way to think of this would be as follows. Suppose that the Treasury follows a certain path of public expenditures. If the Treasury bears the loss, as it does now, it must today either borrow more or raise taxes to finance the given path of public spending. In Barro’s (1974) Ricardian debt equivalence model, these two measures are equivalent. People know that today’s debt will have to be repaid through future taxes, so whether you raise taxes today (and then do not borrow today) or tomorrow (to pay for today’s borrowing, if you borrow today) does not matter. In the end, taxes are raised. When taxes create distortions, the hole in the budget that Fed’s losses create will have negative economic consequences. In this sense, one would argue that it is better to let the private sector (represented by the institutional investors who hold most government bonds) bear the losses. If you agree with this line of thinking, this (Fed’s losses) is another cost of QE.

What is the relationship between realised and unrealised losses?

In my last analysis (link), I described the Fed’s (and other central banks’) unrealised losses on their bond holdings. In this analysis, I describe the Fed’s realised losses. Let me briefly discuss the differences and similarities between these unrealised and realised losses.

One often hears the argument that unrealised losses do not matter because the Fed receives the principal at maturity. If the Fed holds the bonds to maturity – which it does – it never realises the loss on the bond. While it is true that the Fed receives the full amount at maturity, it is not true that the unrealised losses are not real. If a bond trades at 90 and the face value is 100, the bond has lost 10. In other words, the unrealised losses reflect the fact that the Fed is holding a low-yielding security funded by high-yielding liabilities (bank reserves and reverse repos), which means that the unrealised losses represent a smaller future transfer to the Treasury. As the Fed itself writes (link): “While an unrealised gain or loss position on the SOMA portfolio has no direct impact on the Fed’s net income, an expected higher policy rate path would cause an unrealised loss position, indicating a higher future interest expense.” So, the unrealised losses on the Fed’s bonds may remain unrealised, but they indicate the amount of future losses that the Fed will realise.

Conclusion

Normally, central banks make profits which they remit to the Treasury. Today, many central banks make losses, including the Fed. When the Fed realises a loss, it does not write off its equity as an ordinary business would. Instead, the Fed uses a nifty little trick: It simply creates an item on its balance sheet to show the loss. However, the realised losses do not disappear even if the Fed’s equity remains unaffected. When the Fed makes a loss, the Treasury receives less revenue. So, the funds to cover the government’s expenses have to be raised elsewhere. Whether this is a real problem depends on many arguments. My own opinion – weighing the arguments for and against – is that the losses have real consequences. Debt is not completely free. The strange drama about the debt ceiling also speaks for such an interpretation.