Today, May 4, 2021, the Council for Return Expectations publishes its updated forecasts. We still expect very low – negative – returns on safe assets, though not as negative as we expected six months ago. We also expect marginally lower returns on risky assets. Compared to six months ago, we thus expect a lower equity risk premium.

I chair the Council for Return Expectations (link). Danish banks and pension companies use our forecasts when they project how their customers’ savings will develop. In this blog post from July last year (link), I describe the history of the council, who we are, why we publish expected returns, what they are used for, and so on.

Twice a year, we update our expectations. Today, we publish our latest forecasts.

The numbers

We publish expected returns on ten asset classes over the next five years, years 6-10, and the next ten years. Returns are average annual returns in Euros/Danish kroner (the Danish kroner is fixed to the euro). These are our latest expectations:

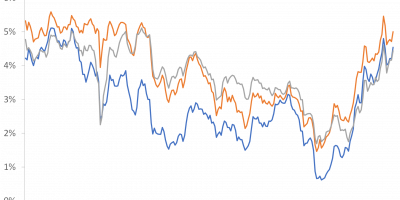

We expect an investment in a portfolio of Danish government bonds, Danish mortgage bonds, and Eurozone government bonds to lose money every year on average over the next five and the next ten years. Over the next five years, for instance, the expected average annual return is -0.7%. At the same time, we expect inflation in Denmark to average 1.4% per year over the next five years. The expected real return is thus close to -2% per year. It is no fun to invest in safe assets these days.

We are less pessimistic than we were six months ago (link), though, not least due to the rise in yields since our previous forecasts. Six months ago, we expected the government and mortgage bond portfolio to lose 1.2% per year on average over the next five years. Today, we expect this portfolio to lose 0.7% per year, as mentioned.

At the same time, we expect slightly lower equity returns going forward. The main reason is the stock-market rally we have witnessed since March 2020, increasing the valuation of stocks. As an example, we now expect global equities to return 5.4% per annum over the next five years. Six months ago, our forecast was 5.6%. This means that we have lowered our forecast for the equity risk premium over the next five years from 5.6% – (-1.2%) = 6.8% to 5.4% – (-0.7%) = 6.1%. Still a sizeable compensation for taking on risk, but close to one percentage point lower than half a year ago.

Today, we also introduce a forecast for the return on a different investment strategy. The return on the government and mortgage portfolio shown above is the average annual return on a constant-duration portfolio (duration = five years). For investors with a short investment horizon, who want to invest their savings safely, this might not be their preferred investment strategy. Perhaps you just want to buy a short bond and hold it until maturity. Hence, today, we introduce the return on a three-year buy-and-hold portfolio of Danish government and mortgage bonds. This is the 3-year zero-coupon rate on a portfolio of 1/3 Danish government bonds and 2/3 Danish mortgage bonds. The three-year buy-and-hold return on this portfolio is -0.4%. Notice that this is not an expected return, but the actual return investors obtain from buying such a bond portfolio today and holding it until maturity.

We also publish standard deviations for all asset classes and for all horizons, as well as correlations, fees, inflation rates, and many other interesting things. You can find all these numbers on the webpage of the Council: link.

An interesting paper

We base our forecasts on inputs (Capital Market Assumptions) from international investment companies, advisors, and banks. This time, we have received inputs from Blackrock, J.P. Morgan, and Mercer. (Again, you can find the description of how we do these forecasts here (link)). In the same way as you can discuss everything in life, you can also discuss our reliance on investment companies when making these forecasts. In this light, a recent paper that discusses whether Capital Market Assumptions are “rational” is rather interesting.

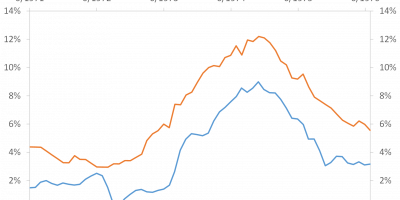

Magnus Dahlquist (link) and Markus Ibert (link) recently sent their new “How cyclical are stock market return expectations? Evidence from Capital Market Assumptions” paper over (link). They analyze Capital Market Assumptions of 43 asset management firms. Their data start in 1992. They look at US equity risk premium predictions, but also show results for other asset classes. They compare expectations of asset managers (Capital Market Assumptions) to expectations of CFOs and other professional forecasters (the Survey of Professional Forecasters, the SPF from the Philadelphia Fed).

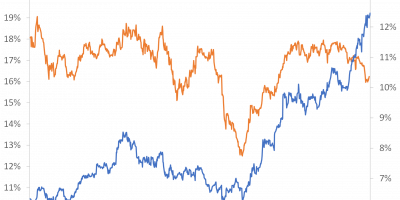

Their main result, and the one that is most important for the return forecasts we make in the Council, is that “asset managers’ subjective equity premium expectations are high when valuations are low and low when valuations are high (countercyclical), and the term structure of subjective equity premium expectations is downward sloping when valuations are low and upward sloping when valuations are high (procyclical).” In this sense, the time-series behavior of Capital Market Assumptions is in line with leading rational asset pricing models. In other words, Capital Market Assumptions seem “rational”.

Magnus and Markus compare Capital Market Assumptions to forecasts by CFOs and SPF forecasts. It turns out that these latter forecasts do not move countercyclically. Magnus and Markus conclude: “Asset managers’ return expectations are the only expectations in consideration that are consistently countercyclical. As such, they are the only ones that actually support rational expectations models.” Hence, there is a good case for using Capital Market Assumption when making return predictions, as we do in the Council for Return Expectations.

By the way, the fact that we today lower our expectations to the risk premium is in line with these results; equity valuations have increased since our last forecast, and we expect a lower equity risk premium as a consequence.

The paper by Magnus and Markus contains a number of other interesting results. For instance, they present striking results on how return expectations changed abruptly during spring 2020, as equity valuations plummeted. Read their paper to learn about these and other findings.

Conclusion

The Council for Return Expectations has published its newest return forecasts. We expect slightly higher (less negative) returns from government and mortgage bonds and slightly lower returns from equities, implying a lower expected equity risk premium.

In the council, we rely on Capital Market Assumption when making forecasts. New research shows that this is a good idea. Capital Market Assumptions move countercyclically, in line with the implications of leading rational asset-pricing models.