If history is any guide, it will be four good years on the stock market if Biden wins on November 3. Historically, stocks have performed so much better under Democratic presidents. The question is whether history will be a guide also this time around.

Are Democratic or Republican presidents better for the stock market? To evaluate, let us recall the performance of the US stock market under Trump – a Republican – and compare it to its performance under Obama – a Democrat and Trump’s predecessor. Afterwards, let us look at the full history of the stock market under Democratic and Republican presidents. Finally, let us discuss what it implies for this election and the next four years on the US stock market.

Obama vs. Trump

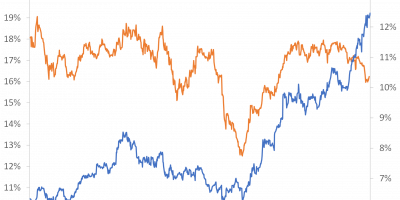

This graphs shows the cumulative return to USD 1 invested in respective January 2009 (Obama 1st term), January 2013 (Obama 2nd term), and January 2017 (Trump). I show real returns, i.e. returns after inflation:

Data source: http://www.econ.yale.edu/~shiller/data.htm

A couple of months remain, but during most of Trump’s presidency, the stock market has performed worse than under Obama. The exceptions are the first few months of Obama’s first term and the beginning of this year, right before the corona crisis.

In numbers, one US dollar invested in the US stock market in January 2009, when Barack Obama – a Democratic president – was inaugurated, had turned into 2.68 USD in December 2016 (when Obama’s second term ended) in real terms, given reinvestments of dividends. This is a total accumulated real return of 168 percent over eight years, or an average annual return of 13%.

One US dollar invested in the US stock market in January 2017, when Donald Trump – a Republican president – was inaugurated, had turned into 1.46 USD in September this year (in real terms). This is a total accumulated return of 46 percent over four years, or an annual average real return of 10% (there are still three months to go of Trump’s presidency, so the numbers might change a little in the end).

Some extraordinary events influenced the stock market under both Obama and Trump.

Early 2009, the stock market was still suffering from the financial crisis of 2008. Obama was inaugurated in January 2009. A few months later (in March 2009), the stock market turned around. Following March 2009, many great years on the stock market followed.

This year, 2020, has seen the fastest bear market in history (in March; link), caused by the corona crisis, hurting the stock market’s performance during Trump’s presidency.

The financial crisis of 2009 and the corona crisis were very unusual events. Perhaps the stock market’s performance under Trump and Obama was unusual.

It turns out that the picture painted above – that the stock market performs better under Democratic presidents – is robust. In fact, the US stock market has historically performed much better under Democrats.

The Presidential Puzzle

Pedro Santa-Clara and Rossen Valkanov published in 2003 a paper (link) entitled ”The Presidential Puzzle”. They documented an intriguing stylized fact: Over the 1927-1999 period, the excess return on the US stock market has been nine percentage points higher under Democratic than Republican presidencies. The average excess returns under Democratic presidencies, they showed, was 11 percent versus 2 percent only under Republican presidents. A nine-percentage point difference is enormous. For instance, it exceeds the excess return on the stock market in general, i.e. the return stocks provide over and above the return on risk-free assets.

Santa-Clara and Valkanov took great care in investigating potential reasons for this stylized fact. The most obvious explanation, financial economists would suggest, is that this is simply a compensation for risk, i.e. that risks have been higher under Democratic presidents. It turns out that this is not the case. In the end, their conclusion was:

”There is no difference in the riskiness of the stock market across presidencies that could justify a risk premium. The difference in returns through the political cycle is therefore a puzzle. ”

Pastor and Veronesi (link) update the results of Santa-Clara and Valkanov. They add app. twenty years of data (until 2015, i.e. their sample runs from 1927 through 2015). Pastor and Veronesi find even stronger results. In their extended sample, they find that the average return under Democratic presidents is eleven percentage points higher than the average return under Republican presidents.

Pastor and Veronesi have this figure with average annual excess returns under each president:

Source: Pastor and Veronesi (2020).

The figure shows that the only Democratic presidency that delivered returns significantly below the average return over the whole period (the dotted line) was Roosevelt’s second term (1937-41). In contrast, a number of Republican presidents have delivered subpar returns (Nixon, first Reagan term, Bush Jr.). My small calculation in the beginning of this post, that returns have been higher under Obama than Trump, strengthens this conclusion.

Pastor and Veronesi show that this finding is robust during subsamples, for instance if excluding the large negative and positive returns during the 1930s. They also show that it is particularly the first year of the presidency that drives these differences. During the first year in office, Democrat presidents have experienced a 37%-points (!) larger return than Republican presidents have:

Source: Pastor and Veronesi (2020).

(If you are interested, here is a detailed account of the stock market’s performance under every single president since Truman: link).

There is some discussion whether this finding (that the stock market does better under leftwing presidents) holds internationally. Pastor and Veronesi show in the (114 pages…) appendix to their article that it holds internationally while others claim that it does not (link). We leave this aside here.

Democratic presidents are elected when times are bad

Pastor and Veronesi develop an interesting explanation of this intriguing pattern of the data. They argue that the reason for the difference between the stock market’s performance under Democratic and Republican presidents has nothing to do with economic policies during presidencies but everything to do with the economic situation when new presidents are elected.

Pastor and Veronesi argue that Democratic presidents are elected at points in time when risk aversion is high. Remember, for instance, the election of Obama in autumn 2008. This was right in the middle of the financial crisis. The worst financial and economic crisis since the 1930s. Everybody was afraid and uncertain how things would evolve. Risk aversion was high. When risk aversion is high, investors demand high compensation for taking on risks in the stock market. Subsequently, investors get compensated by high average returns.

So, the story of Pastor and Veronesi is that Democratic presidents get elected when times are bad. When times are bad, voters have a tendency to vote for left-wing candidates, as voters demand more social insurance during hard times. An important implication of this theory is that Democrat presidents do not cause higher stock returns (and Republican presidents do not cause lower stock returns). Instead, Democratic presidents are elected when the economy is suffering and risk aversion is high, causing high expected returns and subsequent high average returns.

Implications for this election

If (and I write if) it is correct that Democratic presidents get elected when risk aversion is high, and that good returns subsequently follow, what does this imply for this election and the next four years on the stock market?

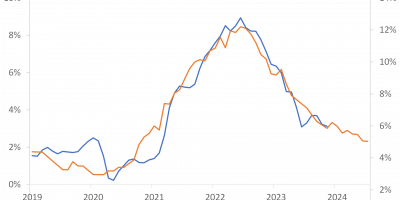

Pastor and Veronesi suggest a number of proxies for risk aversion. To illustrate, let us look at two of them. The first is unemployment. The idea is straightforward: when unemployment is high, people are afraid of taking on risk on the stock market. Risk aversion is high and so are expected returns.

Here is unemployment in the US since 1947:

Source: FRED.

Unemployment is currently high, at 7.9% in September (latest figure at the time of writing). This is more than two percentage points above the historical average rate of unemployment of 5.8%. Unemployment is coming down, though, and fast. Also, there are still two weeks to go until the election. Nothing is for sure. But, as it looks now, this indicates high risk aversion, and thus high expected returns.

Another measure of risk aversion is the habit-persistence idea of Campbell and Cochrane (link). If your consumption is low today, in relation to your past consumption, you feel that times are bad. If you are used to go on holiday a couple of times per year, but now you don’t dare because you are afraid of losing your job, you also become afraid of taking on risk in the stock market. Your risk aversion is high. You require high expected returns if you should be convinced to nevertheless invest in stocks.

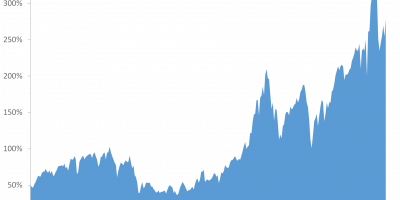

Let me present a simple illustration here, inspired by Atanasov, Moeller, and Priestley: link. I take consumption (real per capita) and divide by habit. I approximate habit by the average of the past three years of consumption (this is a blog, so this should be OK), i.e. the habit ratio is here: C(t)/(AVG[C(t-1)+(C(t-2)+…..+C(t-12]), where C(t) is consumption in period t and AVG is the average. I do this calculation for every quarter since 1950. The result is the following time series:

Data source: FRED.

When an entry in the figure is above one, consumption during that quarter is higher than its past three-year average, and times are good. When the habit-ratio is low, times are bad. The habit ratio (current consumption to habit) thus has a tendency to drop around recessions (1980, 2008, etc.), as, during recessions, people cut consumption in relation to past their consumption.

The lower is the habit ratio, the higher is risk aversion and thus expected returns. Currently, due to the enormous drop in consumption resulting from the corona-crisis, the habit-ratio is historically low. Times are bad. Consumption is low. Biden should win (according to this theory). Risk aversion is high. Expected returns should be high. The next four years on the stock market should be good.

There is uncertainty, of course

Many things can happen until November 3 and the next four years. And, for sure, this has been a really weird campaign. Nothing is for sure.

Some reservations:

My figure with the habit-ratio is based on quarterly data (consumption is quarterly). The last entry is Q2 2020. Since Q2, the stock market has been sprinting ahead, implying that the potential for future returns is, all else equal, lower now than in Q2.

Also, financial markets have been pricing in an enormous amount of event risk surrounding this election. The uncertainty surrounding this election is high. Protection against event risk is expensive (link, link, and link).

At the same time, the stock market has been doing really well since March 23 (link). This is unlike recessions in general. During normal recessions, the stock market tanks. This stock market rebound since spring, everything else equal, reduces the potential for future returns as of now.

On the other hand, at least right now, the polls seem to offer some support for the story. We are in a big downturn (corona crisis). In downturns, people have a tendency to vote left-wing. As we all know, Biden leads the polls at the time of writing:

Source: www.realclearpolitics.com.

Conclusion

The stock market has performed worse under Trump than under Obama. This is not an outlier. Historically, the US stock market has performed much better under Democratic presidents.

One explanation why the stock market performs well under Democratic presidents is that Democratic presidents get elected during bad times, when risk aversion is high.

Currently, we are in the midst of a terrible situation (corona crisis). Supporting this theory, Biden leads the polls. If history is any guide, this indicates good years ahead on the stock market. Not necessarily because Biden – if he wins – implements policies that support the stock market (perhaps he does, but this is not the point of the theory), but because risk aversion is high right now, at the time of the election.

Of course, so many things can happen. This certainly has been a strange (and, at least for many Europeans, myself included, a very weird and scary) campaign to follow from the sideline. The performance of the stock market during this recession has also been weird. It is important to recognize that the stock market rebound since March reduces the potential for future returns as of now. And, in general, so many things can happen during the next four years. Perhaps the situation will thus play out differently this time around. We will know how the election turns out in two weeks, and we will know how the stock market performs during the next presidency in four years and three months. It will be interesting to follow.