Inflation is high, budget deficits are enormous, monetary policy is expansionary, and energy prices are rising. It looks like the 1970s, and some fear high and persistent inflation is coming back. Is it?

For the past three months, US inflation has been running at close to five percent. This is a lot. During the past four decades, inflation has typically hovered around 2%-3%. We also see high inflation in some other countries. In Germany, a country known for its inflation resistance, inflation hovers around 2.5%, a level last seen in 2008.

Rapid post-pandemic economic growth, caused by loose monetary and fiscal policies and a return to something resembling normality after the pandemic, together with supply-chain bottlenecks and rising energy prices are the reasons. The fact that post-pandemic economic growth is high is obviously good, but debate rages whether fiscal and monetary policies are too expansionary. People worry that this spike in inflation might not be temporary. Highly esteemed economists, such as Lawrence Summers (link) and Olivier Blanchard (link), sound alarm that inflation is coming back in the US.

I agree there are worrying signs. In fact, a number of economic developments resemble those of the 1970s. The chronic high inflation rates of the 1970s lasted until the Fed hiked interest rates dramatically around 1980, causing the severe 1981-82 recession. Is this what we are heading for; a long period with persistently higher rates of inflation?

Inflation in the 1970s

It is useful to recall the inflation experience of the 1970s. Figure 1 shows annual US inflation since 1960.

Source: Fed St. Louis Database

Inflation in the 1960s was low and stable around 1.5%. During the late 1960s, inflation started taking off, only to rise dramatically during the early 1970s and late 1970s. At its worst, consumer prices rose by 15% on an annual basis in 1980.

To get inflation and inflation expectations under control, the Fed and its new Chairman Paul Volker tightened monetary policy draconically, driving the Effective Fed Funds Rate to double-digit levels in the early 1980s. This brought inflation under control, but also caused the 1981-82 recession. The 1981-82 recession remains one of the worst economic downturns in the US since the Great Depression of the 1930s. Unemployment reached more than 10%. Because high rates of inflation had been allowed to persist for more than a decade, bringing it under control was very costly.

Since the early 1980s, inflation has remained below 5%.

The current high rates of inflation also appear from Figure 1. Except from July 2007, the app. 5% rate of inflation realized in May, June, and July this year were the highest since 1990.

This is not only a US story. Similar inflation experiences plagued other countries during the 1970s. In the Appendix to this blog, I present inflation rates from Denmark, France, and the UK to illustrate with a few other countries. The inflation experiences are the same. Low inflation during the 1960s, high inflation during the 1970s, and low inflation since then.

What caused inflation in the 1970s?

Alan Blinder has this easy-to-read, but nice, account of what caused inflation in the 1970s (link). He emphasizes that the 1973 spike in inflation was due to a spike in food and energy prices (read: oil prices). The 1979 spike was due to a spike in energy prices and mortgage payments (caused by higher interest rates). Blinder also emphasizes that only few prices rose dramatically, i.e. relative prices changed.

In addition to developments in food and energy prices, it is important to understand the role of monetary policy. Monetary policy was too loose during the late 1960s and early 1970s.

When inflation started rising during the late 1960s, as a result of the expansionary fiscal policies that resulted from the Vietnam war, and kept on rising for the reasons just mentioned (food and energy prices), monetary policy was not tightened, as Bradford De Long explains (link). De Long writes (pp. 264): “Thus there is a very real sense in which monetary policy did not contain inflation in the early 1970s because it was not tried. And it was not tried because the chairman of the Federal Reserve did not believe that it would work at an acceptable cost”. Monetary policy ended up being too lose during the 1970s.

Why was monetary policy not tightened? Back then, economists and policymakers, including then Fed Chair Arthur Burns, believed in the Phillips-curve. The Phillips-curve is the idea that a trade-off between unemployment and inflation exists: You can lower unemployment by raising inflation, and vice versa. Policymakers feared that unemployment would increase if they tightened monetary policy to bring down inflation.

We know today that there is no long-run tradeoff between inflation and unemployment

Today, we no longer believe that there is a permanent trade-off between inflation and unemployment. We believe the long-run Phillips-curve is vertical.

There probably is a short-run trade-off between economic activity and inflation (even when even a short-run Phillips-curve can be hard to trace in the data, link). In fact, today’s monetary policy is based on the idea that a short-run trade-off exists. Central banks lower policy rates to get the economy going and increase inflation, when inflation is too low, and vice versa. We do not believe, though, that you can permanently hike inflation and reduce unemployment as a result. The situation since the 1980s testifies this. Inflation has been low since the early 1980s, but unemployment has not been higher than it was during the 1970s.

We also understand today that inflation expectations matter. If inflation remains high, and policymakers do not combat it, inflation expectations rise. If workers see inflation running at 5% per year, and expect this to persist, they will require at least 5% wage growth. This hurts earnings of firms. Firms will respond by further raising prices. We get stuck in a bad equilibrium of the same, or perhaps even higher, unemployment and high inflation. Better bring down inflation in the first place. This will lower inflation expectations, and real prices and wages will remain contained, with no long-run effects on unemployment. With low and stable inflation, firms and workers can better plan for the future, promoting stable economic growth.

The situation today

Today’s situation resembles the situation during the 1970s along a number of dimensions.

Monetary policy is very loose. As we all know, interest rates are basically zero today, and central banks are buying bonds like crazy. Just to illustrate, I update my graph of the size of the balance sheets of the ECB and the Fed in Figure 2, normalized to one in 2003.

Source: Fed St. Louis Database

The balance sheets of both the Fed and the ECB are ten times larger today than they were before the financial crisis. Since March 2021, the balance sheets of both central banks have almost doubled.

So, monetary policy was loose during the 1970s and monetary policy is loose today. This is a similarity.

The crucial difference to the 1970s is of course that we do not today know whether current monetary policy is too expansionary. We know that monetary policy during the 1970s was not tightened enough, i.e. was too expansionary. Today, we can see that monetary policy is expansionary, but we do yet not know if it is too expansionary. We are living QE now, but we are not blessed with perfect foresight.

Fiscal policy is very loose. 2020 fiscal deficits have been enormous, in many countries the largest since World War Two. In the US, for instance, the 2020 deficit accumulated to more than 15% of GDP. But this recession has also been severe, probably justifying big spending. Nevertheless, this–the fact that fiscal policy is very expansionary today–is what makes economists such as Blanchard and Summers fear that inflation is on an unstainable path.

During the 1960s, fiscal policy was expansionary, too, due to the Vietnam War, laying the foundations for rising inflation during the 1960s.

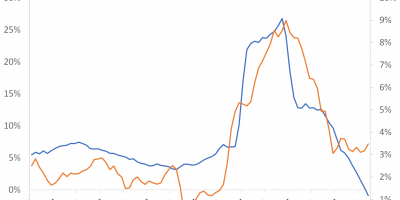

Oil prices are rising. Like in the 1970s, we have recently seen a surge in oil prices. Figure 3 shows the annual change in oil prices since 1960. The percentage increase in oil prices from April 2020 to April 2021 (close to 300%!) exceeds the percentage increase during the First Oil Price Shock in the early 1970s.

Source: Fed St. Louis Database.

True, the behavior of oil prices during spring 2020 was very weird (link), explaining the recent large jump compared to last year, but oil prices have been rising steadily since April last year, now reaching a level last seen in 2014.

Some have argued that today’s inflation is not broad-based but concentrated to a few goods, such as oil prices, other energy prices, prices of semi-conductors, and so on. This gives hope, they argue, that inflation will be temporary (e.g. here: link). When supply-chain bottlenecks are resolved, inflation will contract. This might be true, but recall that inflation was also concentrated to a small segment of the consumer price index during the 1970s. As mentioned, Blinder emphasizes that relative prices changed during the 1970s. Still, the situation during the 1970s was not sustainable and eventually required heavy intervention by the Fed. The fact that rapid price increases are concentrated to a few components of the price index does not in itself secure that inflation will not turn into a bigger problem, as the 1970s showed.

Differences to the 1970s

While the situation today resembles the situation in the 1970s along some scary dimensions, there are also some important differences. Most importantly, I would argue, our understanding of economics and the role of central banks is different today.

During the 1970s, as mentioned, people believed in the Phillips curve. If inflation was running wild, central banks were afraid to tighten policy because they feared it would hurt the labor market.

Today we do not believe in the traditional Phillips curve and its long-run trade-off between inflation and unemployment. We believe that the best monetary policy can do for employment on the long run is to secure low and stable inflation. This is explicitly stated in terms of the inflation targets.

It is true that the inflation targets of both the Fed and the ECB have recently been altered, now accepting a slightly higher rate of inflation. The Fed will now allow inflation to exceed 2%, following a period of low inflation, such that “the average rate of inflation over time approaches 2%” (link). ECB now aims for “a two percent inflation target over the medium term”, replacing its former target of “close to, but below, 2% inflation over the medium term” (link). But the fact that there is an explicit inflation target that requires central banks to act if inflation is missing the target (whether the target is 2%, close to 2%, or whatever) is an important difference to the monetary policy beliefs of the 1970s.

Inflation expectations

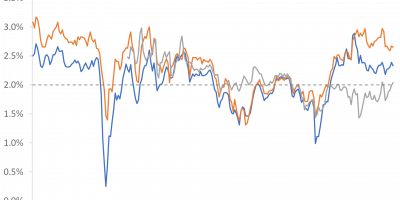

A credible inflation target helps anchoring inflation expectations. Today, in spite of extremely expansionary monetary policy, extremely expansionary fiscal policy, rising oil prices, etc. inflation expectations remain anchored, as Figure 4 shows.

Source: Fed St. Louis Database.

Currently, financial market participants expect inflation over the next five years to be 2.5% per annum and inflation over the subsequent five years (5Y5Y) to be 2.1%. The same goes for professional forecasters, who expect inflation to be 2.75% during 2021-2025 and 2.3% during 2025-2030 (link).

I think this–inflation expectations remain anchored in spite of lots of inflationary pressures in the economy and inflation currently running at 5%–cannot be exaggerated. People seemingly trust the promises of central banks. Should current inflation rates persist, people believe that central banks will intervene, bringing inflation under control. I share this belief. This is a main reason why I think persistent inflation as in the 1970s is not coming back.

Why have inflation been low since the 1980s?

Inflation is not caused by low unemployment per se but by a “too low” rate of unemployment. “Too low” means a lower rate of unemployment than the one that can be maintained without causing inflation. Earlier, this was called NAIRU, or the Non-Accelerating Inflation Rate of Unemployment. Today, the Fed calls it the Noncyclical Rate of Unemployment (NRoU).

The traditional Phillips-curve states that inflation will rise if unemployment is reduced from, say, 6% to 5%. But if NRoU is 3%, there is slack in the labor market and we will not see inflation.

Studying NRoU tells us a lot about why inflation has been relatively low since 1980 and why it was high during the 1960s and 1970s. In Figure 5, I plot the difference between the actual rate of unemployment in the US and the Noncyclical Rate of Unemployment. In red, I plot this difference going forward, using the expected rates of unemployment until 2024, where expectations come from the Survey of Professional Forecasters.

Source: Fed St. Louis Database.

Figure 5 shows that unemployment was generally lower than the NRoU during the 1960s and early 1970s. On average, unemployment was below NRoU. The Fed allowed unemployment to remain so low during the 1970s that inflation skyrocketed. Since the 1980s, the Fed has stabilized inflation by raising interest rates when inflationary pressures accumulated, and has lowered rates when actual unemployment exceeded NRoU. Since 1980, unemployment has on average exceeded NRoU, explaining low inflation.

Given estimates of the future paths of NRoU and the rate of unemployment, unemployment is expected to fall below NRoU in late 2022. If these expectations are realized, and if estimates of NRoU are correct, it will be in late 2022 only that inflation should really kick in, meaning that the inflation rates we see currently are temporary. This is what the Fed refers to when it says that there is still slack in the labor market.

What could go wrong?

The story I have been telling is that I believe we have learnt something from the experiences of the 1970s: there is no long-run trade-off between unemployment and inflation. Central banks will keep inflation at bay. The implication of this story is that persistent inflation as in the 1970s is not coming back.

What could go wrong? Some fear that waning globalization or changing demographics could cause inflation (in Advanced Economies). This is not my biggest worry. I am more afraid about public debt levels and deficits. After describing this, I will explain my second worry, that inflation expectations will start rising.

You all remember the famous words of Milton Friedman: “Inflation is always and everywhere a monetary phenomenon”. This is the Monetary Theory of The Price Level. As you also remember, it can be inferred from the Quantity Theory:

PY/M = v

where P is the price level in the economy, Y real economic activity, M the money supply, and v velocity. Friedman believed v was constant. When real economic activity is determined by things such as productivity and population growth, and when v is constant, any increase in the money supply will be matched by an increase in prices, i.e. inflation. Today, most economists do not believe in this strict version of the Monetary Theory of the Price Level, but believe fluctuations in velocity can alter the relation between M and P and thereby influence inflation. In particular, central banks can use their policy rate to stabilize inflation.

To see why I fear public deficits and debt could cause inflation, recall the so-called Fiscal Theory of the Price Level (FTPL). It starts from a simple expression as well, relating the real value of government liabilities (debt and money, called “B” below) to the present value of future primary fiscal surpluses:

B/P = PV(Future surpluses)

For a given path of fiscal surpluses, increases in government debt today must be met by an increase in the price level, i.e. inflation, for the budget constraint to hold. The point here is that fiscal policies look unsustainable in a number of countries. If debt (B) increases, but policies are not altered, i.e., there will not be sufficient future surpluses, FTPL implies that inflation must give to satisfy the budget constraint.

Figure 6 shows expected US fiscal deficits until 2050. Under current policies, deficits will just keep on accumulating.

I am somewhat afraid of the inflationary pressures that might result from this. One thing is the Fiscal Theory of the Price Level. This provides an easy way of explaining why inflation must give if fiscal policy is unsustainable. There is debate about the theoretical foundations of the FTPL (link) and about its empirical prediction of a relation between fiscal deficits and inflation outside wartimes (link). My fear is thus related to the FTPL but different. I am afraid that central banks are not willing or able to raise rates if required, given the current amount of public debt and the expected paths of future deficits.

Imagine that the Fed or the ECB do raise rates. This will cause headaches for the US and European governments. With so much debt, and higher interest rates, investors might start questioning the solvency of governments. Yields will rise.

There is a dangerous game going on here, between central banks and governments. As long as inflation expectations are contained, there is no need for central banks to raise rates and governments can finance their deficits at low costs. But if inflationary pressures accumulate, central banks need to raise rates. I build my story above on a belief that central banks will raise rates. But what if they do not dare? This is one fear I have, should inflationary forces persist.

The second thing that could go wrong is that inflation expectations start rising. Readers of this blog will know the market-implied probability of inflation exceeding 3% over the next five years has increased, see Figure 1 in this blog (link). On average expectations remain anchored (see Figure 4 above), but people are starting to get nervous about the tails of the inflation distribution. Also, consumers have raised their inflation expectations, as Figure 7 shows. Consumers now expect inflation over the next three years to be close to 4%. This is clearly worrying.

Source: New York Fed.

Now, the dominant belief is that inflation will not persist, as shown in Figure 4 above and the fact that yields are currently very low. But we see signs of uncertainty. My second fear is that this becomes widespread.

If central banks on the other hand do as they promise, I do not see a return to 1970s-like inflation. I stick to that view for now.

Conclusion

Inflation in the US and other countries is high, monetary and fiscal policies are expansionary, and energy prices are rising. This look like the 1970s. Inflation in the 1970s was only brought under control after the Fed hiked interest rates draconically, causing the severe 1982 recession. Are we entering a period with persistently higher–much higher–rates of inflation?

I think we are not. Inflation in the 1970s was allowed to persist because people (economists and central banks) believed that unemployment would suffer if inflation was lowered. Today, we probably believe in a short-run trade-off, but we do not believe in a long-run trade-off between unemployment and inflation. Central banks have explicit inflation targets. I bet that central banks will not allow high rates of inflation to persist.

There are risks. One is that inflation expectations start rising. We see signs, but they are not driving markets. Another is that enormous amounts of government debt could make central banks reluctant to raise rates when needed. Absent these risks, I think persistent and high 1970s-like inflation is not coming back.

Appendix