In my previous analysis (link) I contrasted the Bundesbank and the Fed during the high-inflation episodes of the 1970s. I concluded that the Bundesbank fared better: German inflation was lower and less volatile. Today’s situation resembles the situation in the 1970s. What can monetary policymakers today learn from events back then? A lot, I think. At the same time it also seems as if some important lessons have been forgotten.

The 1970s had sky-high inflation, a war that impacted oil prices, insufficient monetary policy tightening, and an abundance of uncertainties surrounding the economic outlook. All in all a very difficult period for monetary policymakers.

The situation today resembles the 1970s, and today’s policymakers face similar mountains of challengers. But today’s policymakers have one advantage: They can learn from the 1970s.

Fact 1. Today’s rise in inflation match the rise in the 1970s

There were two rounds of inflation during the 1970s, in the early and late 1970s. During both episodes inflation rose more in the U.S.: by 8-10 percentage points in the U.S. versus 4-6 percentage points in Germany. As a result inflation was on average higher in the U.S. It was also more volatile, see my previous analysis (link).

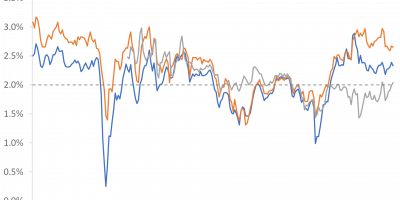

Today’s rise in inflation resembles the experiences of the 1970s. Figure 1 shows that inflation was around 0-1% in the U.S. and Germany in 2020. Today inflation is around 7-8% in both countries, exceeding the 2% inflation target by a very wide margin. Inflation has thus increased by around 7 percentage points in both the U.S. and Germany, similar to developments in the 1970s.

Data source: Fed St. Louis Database.

So, the first important lesson is that today’s rise in inflation is comparable to what we saw in the 1970s.

A further important point is that while inflation rose more in the U.S. in the 1970s, today’s rise in inflation is more or less the same in the U.S. and Germany/Europe.

Fact 2. Monetary policy reacts late today

The second thing we learned from the 1970s was that both the Fed and the Bundesbank started tightening monetary policy as soon as inflation started rising. We can discuss – and we will in the next section – whether they raised monetary policy rates enough, but at least they raised rates immediately.

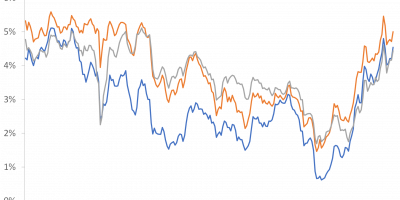

Inflation started rising in the U.S. in 1973. The Fed immediately hiked rates, see Figure 2. In the second round, U.S. inflation started rising in 1977/1978 and the Fed again immediately hiked rates. Hence, the Fed got the timing right, though not the magnitude (see below).

Data source: Fed St. Louis Database.

In Germany the Bundesbank was a slow starter in the early 1970s, probably because of its commitment to the Bretton Woods fixed exchange rate system, but in 1972 Bundesbank started raising rates, see Figures 1 and 2 here. In the second round, in the late 1970s, Bundesbank saw inflation shooting up in 1979 and immediately hiked rates as well.

Today we do not see such immediate responses.

The inflation target of both the Fed and the ECB is 2%. Inflation hit 2% in the U.S. in February 2021. It hit 2% in Germany in April 2021. In the Eurozone, inflation reached 2% in July 2021. More than a year has passed since inflation surpassed 2% in the U.S. and almost a year has passed in the Eurozone.

The Fed started raising rates last month while the ECB hasn’t started yet. Monetary policy rates are thus still below 1% in the U.S. and negative(!) in Europe. On top of this the ECB is still buying bonds for billions of euros, though they have communicated this stops later this year.

Compared to the 1970s, the Fed and the ECB react late this time around.

Fact 3. Real rates are lower today

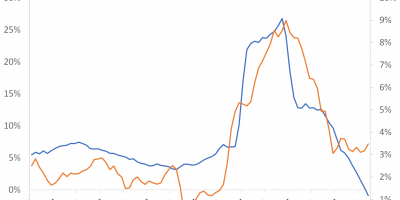

The Bundesbank was able to secure relatively low inflation in Germany during the 1970s because they kept real rates relatively high. Today, in contrast, real rates are very low, as Figure 3 shows.

Data source: Fed St. Louis Database.

Because of surging inflation and monetary policy rates close to zero, real rates are close to -8%! Real rates were not as negative during the 1970s. At its most extreme, real rates were around -5% in the U.S. in 1975 and 1980 (see Figure 3 here). In Germany, real rates did not go below -2% in the 1970s. Today most people agree that U.S. monetary policy was too loose in the 1970s. Given that inflation is now running at 8% it is thought provoking that monetary policy today stimulates inflation more than it did in the 1970s.

The Fed was dovish in the 1970s. Today ECB is dovish

The third thing we learned from the 1970s was that the Fed was more dovish than the Bundesbank. Real rates were lower in the U.S. (around -0.8% on average over the 1974-1981 period versus 1.2% in Germany, see Figure 3 here). This contributed to higher and more volatile inflation in the U.S. Eventually, in the early 1980s, the Fed had to tighten monetary policy draconically to bring inflation under control.

Today, as mentioned, monetary policy is very loose (real rates are around -8%), but the U.S. has at least started raising rates and signals aggressive tightening. The ECB, on the other hand, has not even ended its asset-purchasing program. It will end in Q3 and the ECB will then “some time after that decide interest rate hike and subsequent hikes,” ECB President Christine Lagarde said at the latest ECB press conference (link).

The Fed gives us the dot plots. They indicate what Fed governors expect will happen to the monetary policy rate. The ECB does not give us such a thing. From Lagarde’s press-meeting statement we can infer that rates will not be raised until Q3 2022 but we are left in the dark what happens then.

In Figure 4 I show the monetary policy rates of the Fed and the ECB, as well as the expected path of the Fed Funds rate, derived from the dot plots, and the expected path of the ECB policy rate for the period we know something about. For the sake of illustration I assume this (what we know about ECB’s intentions) to be until Q3 2002. Also for the sake of illustration I assume a linear path for the Fed Funds Rate towards the average dot plots in early 2023 and early 2024. Figure 4 reveals that, as things look now, the Fed is on a more hawkish path than ECB.

Data source: Fed St. Louis Database.

It is somewhat ironical that the Fed was more dovish in the 1970s while the central bank now responsible for monetary policy in Germany–the ECB–is dovish today.

The final lesson learned from the 1970s was that the US did not really gain anything from being more dovish. Inflation was higher than in Germany, but economic activity developed similarly (link). By keeping real rates lower, the U.S. had higher inflation but not higher economic growth.

Now, the ECB appears more dovish. The big question is of course whether this will imply higher inflation in Europe going forward, without any significant economic gain.

Why this delayed reaction? The focus on core inflation

In the 1970s central banks reacted immediately when inflation started rising. Today the Fed and the ECB react too late. This is surprising given that inflation has been increasing for a year and is currently very high at app. 8%.

The Fed has acknowledged they are behind the curve and communicated they will hike rates aggressively this year. The ECB has said almost nothing. It has signalled it might react in Q3 but nothing has been confirmed. With inflation at 8% all alarms should be ringing. Why is nothing happening?

ECB president Lagarde recently gave an interesting interview, comparing Europe and the U.S. (link). She argued there are two reasons why the ECB has not hiked rates: (i) taking out energy and food inflation is lower in Europe and (ii) the labour market is tighter in the U.S. Basically, Lagarde said, the Eurozone is “facing a different beast”.

Figure 5 shows core inflation in the U.S. and the Eurozone, i.e. consumer-price inflation less food and energy.

Data source: Fed St. Louis Database and Datastream via Refinitiv.

Core inflation is currently 3.5% in the Eurozone versus 6.5% in the U.S. As overall inflation is app. 8% in both the U.S. and Europe (8.5% in the U.S. and 7.5% in the Eurozone), food and energy accounts for more than half of inflation in Europe.

Does this mean that the ECB is correct not to raise rates? In my opinion no.

First, the inflation target is 2%. This is a target for the overall rate of inflation. There is no target for core inflation. But even if nevertheless focusing on core inflation, it is still much too high, significantly exceeding the 2% level.

Second, people sometimes say a hike in the monetary policy rate will not bring more oil and gas, i.e. will not lower energy prices. This is correct, but there is a reason why monetary policy targets are formulated in terms of overall inflation: Overall inflation measures the prices of the stuff people buy. Core inflation excludes energy and food, but people buy energy and food. If some prices rise too fast, the central bank must react to make sure other prices rise at a slower pace. ECB might not be able to bring down energy prices by rising policy rates, but ECB can calm down other prices, thereby contributing to a more muted overall rate of inflation. And, remember, these other prices are rising too fast (core inflation 3.5%).

Third, ECB is losing its grip on inflation expectations. During autumn 2021 the ECB constantly stressed (in defence of its passiveness) that inflation expectations were anchored. Alas, they are no longer.

Figure 6 shows the expected rate of inflation over the next five years five years from now (5y5y). It now stands at 2.5%. Inflation over the next two years two years from now (2y2y) is 2.7%. Investors no longer believe ECB will fulfil its target on the medium term.

Data source: Datastream via Refinitiv.

Figure 6 shows expectations of professional investors. There is research indicating that households’ inflation expectations are mainly influenced by the prices they face when they go shopping (link), i.e. the prices they face in supermarkets and when refuelling the car. If this is true “central banks’ focus on core inflation might be misguided when it comes to understanding future inflationary pressures because core inflation, which strips out the volatile price changes of food and energy, excludes the very price changes that most consumers consider when forming their expectations.” (link)

Finally, there are always some prices that rise and some prices that fall. Jim Reid from Deutsche Bank had a nice quote in one of his emails: “One of the most fascinating accounts of the 1970s I read around this time last year was that of the Fed by ex-staffer and famous economist Stephen Roach. When energy spiked, the Chair Arthur Burns asked his staffers to devise an ex-energy inflation series and was comforted that this measure showed inflation was more contained. His view was that this energy spike had nothing to do with monetary policy. But soon he had to ask for another basket to be created ex food and energy. Again he was relatively calm at the lack of inflation elsewhere and believed food price rises were more to do with an El Nino. This stripping out continued until less than a third of the basket was left and eventually the Fed had to admit that inflation was broad based as even this stripped-out inflation series was in double digits.” Today the situation is as follows: Overall inflation in the Eurozone was 7.5% in April 2022. If you exclude energy it was 4.2%. If you exclude energy and unprocessed food it gets down to 3.9%. And if you then exclude energy, food, alcohol, and tobacco you get to 3.5%. Still too high? Other items to exclude?

So, a central bank cannot produce more oil and gas. But the role of central banks is to keep the overall price level stable. If it focuses too much on selected parts of the overall price index, it risks a de-anchoring of inflation expectations.

What about the labour market? I agree that the labour market is less tight in the Eurozone. Also, economic activity has rebounded faster in the U.S. While this is true, it is also true that unemployment has hit its all-time low of 7% in the Eurozone.

The bottom line is that inflationary pressures are more intense in the U.S. On that I agree. This does not mean, however, that there is no inflationary pressure in Europe. In my opinion, the ECB should have acted long ago (in autumn 2021).

Differences between the 1970s and the 2020s

I have described key learnings from the 1970s and discussed today’s monetary policy in this light. While this is interesting, it is also true that there are differences between the 1970s and the 2020s. For example, energy is less important for economic activity today. The natural rate of interest is also lower. There is war in Europe, making the situation very difficult for the ECB. Finally, I agree that some of the factors affecting inflation today are transitory. This means that inflation will come down somewhat. It will, however, not come down enough if monetary policy remains expansionary and stimulates inflation.

How much should monetary policy rates be raised? Even if inflation is 8%, rates should of course not be raised by 8 percentage points. That would be completely crazy. But rates should have been raised already and asset purchases should have stopped. I admit I was shell-shocked when ECB president Lagarde in December last year said it is “very unlikely” that rates would be raised in 2022 (link). Back then inflation was 5%. Now it is 8%. How can you rule out a hike in rates when inflation is running at 5%? The fact that the ECB has taken so long means it will be more difficult to get inflation under control. This is unfortunately a reminder of the 1970s.

I am critical but I also understand the challenges the ECB is facing. The situation is difficult and there are many people around the table (link). At the end of the day, however, I believe that monetary policy should not address too many targets. Monetary policy should focus on the most important goal, that is keeping inflation low and stable.

Conclusion

Inflation started rising dramatically last year. The textbook says central banks should hike rates. They did in the 1970s, but have not done so today, in particular the ECB. Real rates are thus very negative. Monetary policy stimulates inflation. It is now running at 8%.

The lesson from the 1970s is that when central banks do not react to inflation, inflation will remain high with no gain for economic activity.

In august last year, I argued that central banks had learned from the policy mistakes of the 1970s and would not repeat them (link). I still hope this is true. There are signs ECB is finally preparing for take-off, but I fear the slow reaction and reluctance to raise rates could mean ECB repeats some of the mistakes of the 1970s.