Archives

Page 2/9

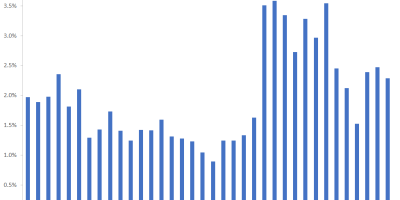

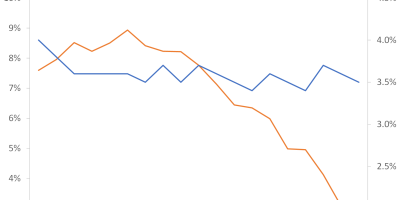

Have interest rates risen fundamentally?

Corona crisis, Fiscal policy, Inflation

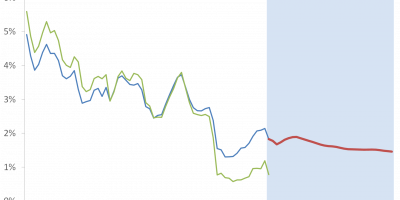

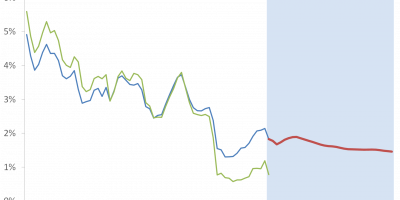

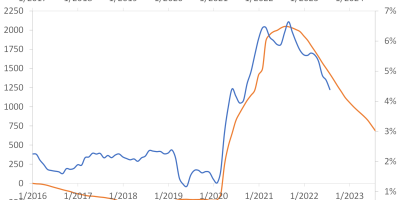

When will there be no more excess savings left?

Corona crisis, Interest rates, Monetary policy, Recessions

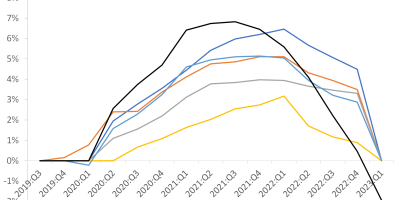

Why no recession (yet)?

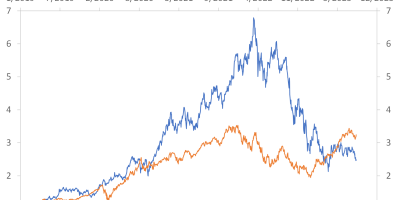

A few stocks drive the stock market: Dot.com vs. today vs. the last 100 years

7 or 493 stocks: What matters for the S&P 500?

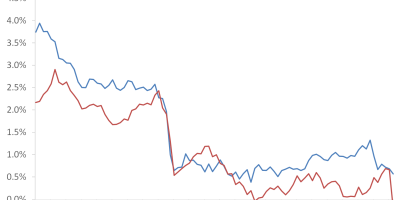

Inflation, unemployment and the Phillips curve: The 1970s vs. today

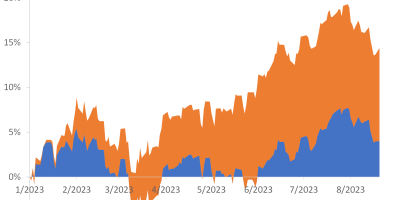

US core inflation: 2 percent or 5 percent?

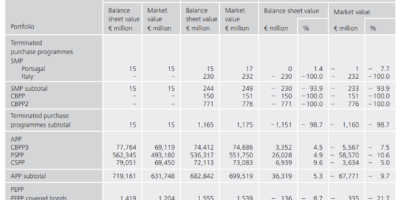

Central banks, Eurozone, Interesting papers, Monetary policy

ECB earned exactly zero (0) euros in 2022. A surprising coincidence or a sign that central bank losses matter?