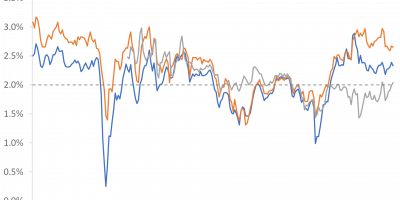

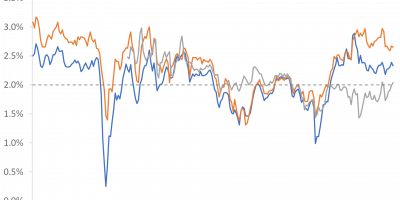

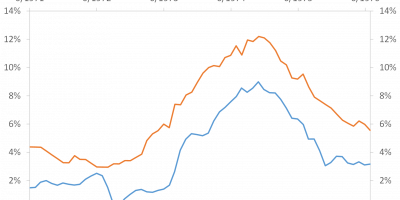

Inflation, Inflation expectations, Real interest rates

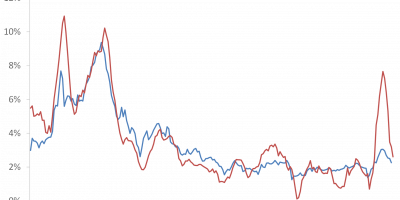

A fact-based blog on finance and economics

Inflation, Inflation expectations, Real interest rates

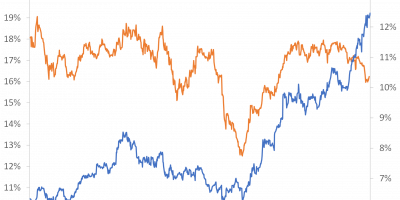

Danish economy, Exchange rates, Monetary policy

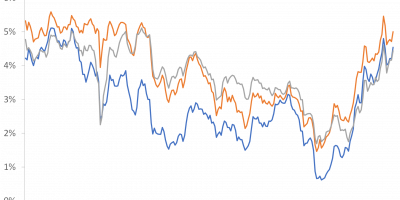

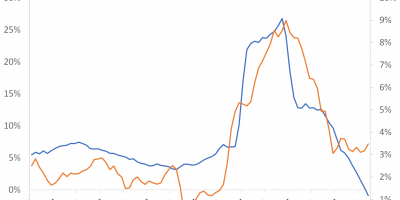

Central banks, Inflation, Interest rates, Monetary policy

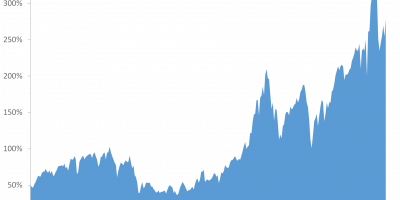

Interesting papers, Stock markets

Interest rates, Interesting papers, Return expectations, Stock markets

Central banks, Inflation, Inflation expectations, Monetary policy

Central banks, Inflation, Monetary policy, Recessions, Stock markets